The idea of owning a cask of Scotch whisky is deeply alluring-a tangible piece of heritage, quietly maturing into a valuable asset. Yet, for many aspiring connoisseurs, the journey to buy a cask of scotch seems shrouded in mystery, filled with complex jargon, hidden costs, and the unsettling risk of fraudulent brokers. The dream of securing your own liquid legacy can quickly feel opaque and out of reach, but it doesn’t have to be.

This is where passion meets pragmatism. Cask ownership is more than an indulgence; it is a sophisticated, alternative investment that connects you directly to centuries of craftsmanship. It represents a unique opportunity to build a personal legacy while securing a rare and appreciating asset for the future.

This comprehensive guide is designed to provide the clarity and confidence you need. We will illuminate every essential step, from selecting a distillery with impeccable provenance to navigating secure storage, insurance, and taxes. Prepare to move from aspiration to confident action, equipped with the knowledge to acquire your first premium cask.

Key Takeaways

Key Takeaways

- Understand how cask ownership uniquely blends a passion for craftsmanship with the pragmatism of securing a tangible, appreciating asset.

- Discover the fundamental differences between acquiring a cask from a distillery versus a specialist broker to determine the right path for your journey.

- Learn the key variables beyond the distillery name-such as wood provenance and maturation potential-that truly drive value when you buy a cask of scotch.

- Navigate the essential legalities of ownership and the ongoing management required to protect and mature your liquid legacy after the purchase is complete.

Table of Contents

- Why Buy a Cask of Scotch? The Allure of Liquid Gold

- The Two Paths to Ownership: Distillery vs. Cask Broker

- Selecting Your Cask: A Checklist for First-Time Buyers

- The Purchase Process Demystified: From Enquiry to Ownership

- Life After Purchase: Managing Your Maturing Asset

Why Buy a Cask of Scotch? The Allure of Liquid Gold

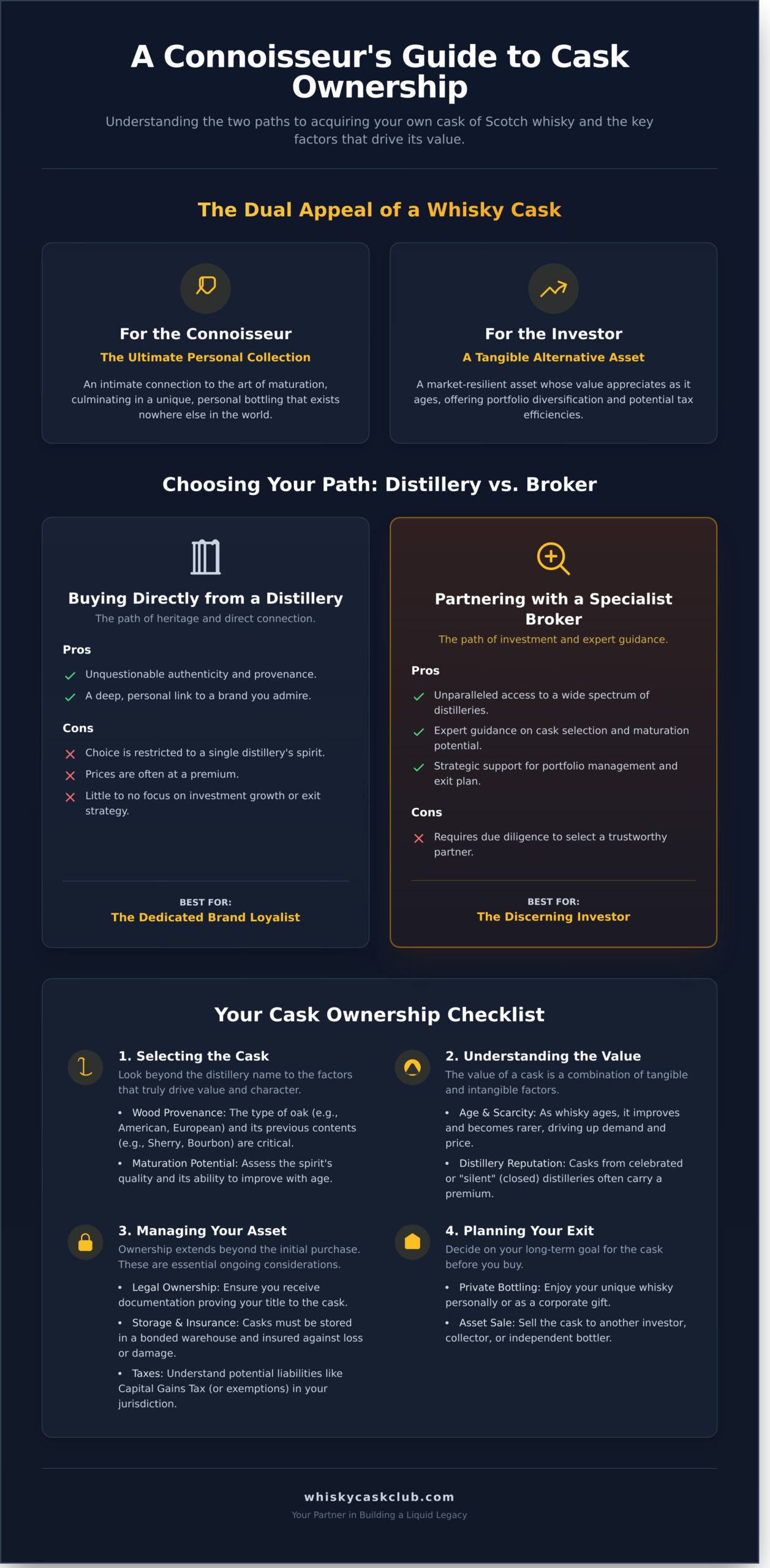

To buy a cask of scotch is to acquire more than just a spirit; it is to own a tangible piece of Scotland’s rich heritage and craftsmanship. This unique opportunity holds a dual appeal, satisfying both the passionate connoisseur and the pragmatic investor. Within each oak barrel lies a maturing Scotch whisky, a spirit protected by law and revered globally for its complexity and provenance. Owning a cask is a journey into the heart of this tradition-an asset that is both deeply personal and financially sound, culminating in the creation of a lasting legacy.

For the Connoisseur: The Ultimate Personal Collection

For the whisky enthusiast, cask ownership is the ultimate expression of passion. It offers an intimate connection to the art of maturation, allowing you to witness a raw spirit evolve into a complex, magnificent whisky over years or even decades. This journey provides a direct link to the distillery’s craft and culminates in the exclusive opportunity to create a unique, personal bottling-a rare spirit that exists nowhere else in the world, bottled at your preferred strength and age.

For the Investor: A Tangible Alternative Asset

From a financial perspective, a whisky cask represents a compelling alternative investment. As a tangible asset, its value is not directly correlated with volatile stock markets, offering a robust hedge for a diversified portfolio. The core principle of its value appreciation is simple and powerful: as the whisky ages, it improves in quality and becomes scarcer, driving demand. This asset class also presents distinct advantages:

- Natural Appreciation: Value increases through the simple, managed process of aging and maturation.

- Market Resilience: Historically, the fine whisky market has shown strong performance, even during economic downturns.

- Tax Efficiency: In some jurisdictions like the UK, whisky casks can be classified as a ‘wasting asset’, potentially exempting them from Capital Gains Tax upon sale.

This blend of passion and pragmatism makes cask ownership a sophisticated strategy for building a legacy-a unique and valuable asset to be enjoyed or passed down through generations.

The Two Paths to Ownership: Distillery vs. Cask Broker

Once you have decided to buy a cask of scotch, your first crucial decision is choosing your acquisition path. This choice fundamentally defines your experience, from the selection available to the level of guidance you receive. The two primary routes-purchasing directly from a distillery or partnering with a specialist cask broker-cater to distinctly different goals. Understanding their models is essential to aligning your purchase with your long-term vision, whether it be for passion, portfolio diversification, or building a lasting legacy.

Buying Directly from a Distillery

Acquiring a cask from its source offers an undeniable romantic appeal and a direct connection to the craftsmanship. This path guarantees impeccable provenance, as you are purchasing a new-make spirit that meets the exacting standards of both the distillery and the Scotch Whisky Association. However, this route has its limitations.

- Pros: Unquestionable authenticity and a personal link to a brand you admire.

- Cons: Choice is restricted to that single distillery’s spirit, prices are often at a premium, and the focus is rarely on investment growth or exit strategies.

This approach, often managed through exclusive cask schemes with long waiting lists, is ideal for the dedicated brand loyalist or connoisseur intent on owning a piece of their favourite distillery’s heritage.

Partnering with a Specialist Cask Broker or Club

For those focused on building a valuable, tangible asset, a reputable cask broker or club provides unparalleled market access and expertise. A specialist partner operates across the entire industry, sourcing rare and promising casks from a wide spectrum of celebrated and silent distilleries alike. This model is built around the principles of investment and portfolio management.

- Pros: A curated selection from across the market, expert guidance on cask selection and maturation, and strategic support for your exit plan.

- Cons: The market requires careful navigation; performing due diligence to select a trustworthy partner is paramount to protect your investment.

This path is designed for the discerning investor seeking to diversify their portfolio with premium whisky casks, guided by expert insight. A trusted partner provides not only exclusive access but also the security and strategic counsel necessary for success. Discover our process.

Selecting Your Cask: A Checklist for First-Time Buyers

To successfully buy a cask of scotch, an investor must look beyond the celebrated distillery name. While provenance is paramount, the true value of this tangible asset is a symphony of interconnected factors. This framework is designed to move you from enthusiast to informed investor, balancing personal taste with the sound principles of asset appreciation and legacy building.

The Distillery’s Pedigree and Reputation

A distillery’s reputation is the cornerstone of a cask’s future value. Iconic names like Macallan or Springbank command a premium due to their global recognition and proven track record in the secondary market. Conversely, respected “workhorse” distilleries, while less famous, produce exceptional spirit and can represent outstanding value for the discerning investor. Diligent research into a distillery’s history, production style, and market demand is a non-negotiable step in securing a cask with genuine legacy potential.

The Critical Role of Wood: Cask Types and Sizes

The cask itself is responsible for over 60% of the final whisky’s character. Understanding the nuances of wood is critical to your investment:

- Oak Type: American Oak (Quercus alba) imparts classic notes of vanilla and coconut, while European Oak (Quercus robur) offers richer tones of spice and dried fruit.

- Previous Contents: Ex-Bourbon barrels are the industry standard, creating a classic Scotch profile. Highly sought-after Ex-Sherry butts bestow deep, complex, and fruity characteristics that are prized by collectors.

- Cask Size: Maturation is a dialogue between spirit and wood. A smaller Barrel (~200 litres) offers a faster maturation than a larger Hogshead (~250 litres) or Butt (~500 litres) due to a higher wood-to-spirit ratio.

New Make Spirit vs. Mature Casks

Your investment timeline will dictate whether you choose a new or mature spirit. Acquiring a New Make Spirit cask allows you to shape the whisky’s entire journey from day one-a true long-term play in crafting a unique asset. Alternatively, purchasing a Mature Cask means investing in a whisky with an established flavour profile and a clearer path to exit. Before you decide, it is crucial to understand the full implications of ownership, and the official Scotch Whisky Association Cask Investment Guidance provides an essential, non-commercial overview of the responsibilities involved.

The Purchase Process Demystified: From Enquiry to Ownership

Acquiring a tangible asset like a premium whisky cask is a significant step in building your legacy. The process, while detailed, is designed to be transparent and secure, protecting your investment at every stage. A meticulously managed transaction is the hallmark of a reputable partner, transforming a complex acquisition into a seamless experience.

Due Diligence and Initial Enquiry

Your journey begins with rigorous vetting. Before you commit, request a full cask profile detailing its provenance, wood type, and distillation date. Crucially, you must see a recent ‘Regauge’ report. This official document provides an up-to-date measurement of the cask’s contents, including its exact liquid volume and Alcohol by Volume (ABV). This data is non-negotiable for confirming an accurate valuation and the health of the spirit within.

Payment and Transfer of Ownership

Once you decide to buy a cask of scotch, secure payment is paramount. Transactions should always be conducted via verifiable methods like a direct bank transfer. Upon receipt of funds, the transfer of legal title is executed through two key documents:

- The Delivery Order: This is the single most important document in your acquisition. It is a legal instruction from the seller to the bonded warehouse, ordering them to transfer the ownership of the specified cask directly to you.

- Certificate of Ownership: This document, issued by your broker or seller, serves as a formal confirmation of your purchase and details the specifics of your cask.

Confirming Your Asset is Secure

True ownership means having direct confirmation from the custodian of your asset. Once the Delivery Order is processed, you should contact the HMRC-regulated bonded warehouse directly to verify that the cask, identified by its unique number, is now registered under your name. For ultimate control, we recommend setting up your own private account with the warehouse. This establishes a direct relationship, ensuring all storage invoices and communications come straight to you, solidifying your undisputed ownership.

This structured process ensures your investment is not just a line on a spreadsheet, but a secured, tangible asset with clear provenance. To explore our curated selection of investment-grade casks, please visit the Whisky Cask Club.

Life After Purchase: Managing Your Maturing Asset

The decision to buy a cask of scotch is the beginning of a remarkable journey, not the final destination. Once you hold the title to your cask, your role as custodian begins, overseeing the slow and magical transformation of new-make spirit into a rare, maturing asset. This phase of ownership is critical and requires professional management to protect your investment and ensure it reaches its full potential, building a legacy of exceptional value and flavour.

The Role of the HMRC Bonded Warehouse

By law, every cask of Scotch whisky must be stored in a secure, government-regulated HMRC bonded warehouse in Scotland. This ensures its provenance and offers a significant financial advantage: UK excise duty and VAT payments are deferred until the whisky is bottled or removed from bond. More importantly, these facilities provide the dark, cool, and stable conditions essential for the slow, graceful maturation that defines premium Scotch whisky, protecting the craftsmanship held within the wood.

Insurance: Protecting Your Tangible Asset

A cask is a valuable, tangible asset that demands comprehensive protection. We consider all-risks insurance to be a non-negotiable cornerstone of responsible ownership. A robust policy provides full coverage against unforeseen events, ensuring your investment is secure. Key coverage includes:

- Fire, flood, and water damage

- Theft and malicious damage

- Accidental damage during handling or transit

Crucially, the policy’s insured value must be reviewed regularly to reflect the appreciating worth of the maturing spirit inside.

Monitoring Maturation: The Angel’s Share and Sampling

Over the years, a small portion of whisky naturally evaporates from the oak cask-a romantic loss known as the ‘Angel’s Share,’ typically around 2% per year. Regular monitoring includes re-gauging to measure this volume and check the alcohol strength. Drawing small samples allows for expert analysis of the spirit’s evolving character, tracking its journey as it develops complexity, colour, and aroma. This is where the true art of maturation is revealed. When you work with us, our experts manage this entire process on your behalf. Learn about our services.

Your Legacy in Liquid Gold Awaits

Embarking on the path to cask ownership is a journey into the heart of whisky craftsmanship. You now understand that this is more than a purchase; it’s a tangible investment in both passion and potential. From selecting the right distillery to navigating the purchase, the key is to proceed with knowledge and expert counsel. To buy a cask of scotch is to acquire a piece of heritage, a story that matures and deepens with each passing year.

At Whisky Cask Club, we specialise in turning aspiration into ownership. We provide our members with exclusive access to rare casks from world-renowned distilleries, all managed and protected in secure HMRC bonded warehouses. Our team offers expert guidance dedicated to helping you build and manage a distinguished legacy portfolio.

Request a consultation to begin your cask ownership journey. Your personal legacy, maturing in oak and spirit, awaits.

Frequently Asked Questions

What is the minimum investment required to buy a cask of Scotch?

The entry point to buy a cask of scotch typically begins around £3,000. This initial investment secures the new-make spirit and the physical cask itself. However, the cost varies significantly based on the distillery’s prestige and the age of the spirit. Casks from more sought-after, premium distilleries will command a higher price, reflecting their rarity and greater potential for appreciation. We provide a curated list of options to match your investment goals.

How long should I plan to keep my whisky cask before selling or bottling?

While Scotch whisky is legally mature after three years, we view cask ownership as a long-term strategy for building a legacy. We generally advise a maturation period of at least 8 to 12 years to allow the spirit to develop profound character and for the asset to achieve significant value appreciation. Patience is paramount; the most remarkable returns are realised by those who allow the craftsmanship within the cask to fully express itself over time.

What are the annual costs associated with owning a whisky cask?

Owning a tangible asset of this calibre requires professional care. The annual costs are for secure storage in a government-bonded warehouse and comprehensive insurance. You should budget approximately £50 to £100 per year per cask for these services. This fee ensures your investment is protected against theft and damage under optimal maturation conditions, safeguarding its provenance and value until you are ready to realise your asset’s potential.

What documents prove that I am the legal owner of the cask?

Your ownership is established through official, legally recognised documentation. Upon purchase, you will receive a Certificate of Ownership, which acts as your title deed to the cask. You will also be issued a Delivery Order or Warehouse Receipt. This document, unique to your cask, confirms its storage in the bonded warehouse and grants you the sole authority to move, sample, bottle, or sell the liquid within. This ensures complete transparency and security for your asset.

Can I visit my cask in the bonded warehouse in Scotland?

Yes, we believe that connecting with your investment is a unique part of the ownership journey. Visits to the bonded warehouse to see your cask are welcome and can be arranged. Due to strict HMRC regulations and security protocols, all visits must be scheduled in advance. This exclusive opportunity allows you to witness firsthand the environment where your rare spirit is maturing, adding a personal dimension to your legacy asset.

What is a ‘wasting asset’ and how does it apply to whisky casks for UK taxpayers?

In the UK, a ‘wasting asset’ is defined as property with a predictable useful life of 50 years or less. As a cask of whisky is intended to be bottled and consumed within this timeframe, it qualifies for this classification. The primary benefit for UK taxpayers is that any profit realised from the sale of your whisky cask is currently exempt from Capital Gains Tax (CGT). We always recommend seeking independent financial advice for your personal circumstances.

What are my options when I decide to sell my cask?

When your cask has reached its optimal maturation, you have several routes to market. You can sell it to another private investor through our exclusive network, offer it to an independent bottling company, or in some cases, sell it back to the original distillery. Each path offers distinct advantages. Our role as your trusted advisor is to provide expert guidance and access to these markets, ensuring you achieve the most favourable outcome for your investment.