Does the relentless volatility of public markets leave you questioning the security of your financial legacy? As inflation continues to challenge traditional returns, the search for genuine portfolio resilience has become more critical than ever for the discerning investor. The strategic outlook for alternative asset investment 2026 is not merely a trend; it is a fundamental shift towards assets with tangible, real-world value-assets that are not beholden to the daily whims of the stock market.

This guide is your curated map to this exclusive landscape. We will demystify the world of private markets, explore investments you can see and touch-from rare whisky casks to fine art-and reveal how to integrate these powerful, non-correlated assets into your portfolio. Prepare to move beyond the conventional, protect your wealth, and build a truly enduring financial future rooted in craftsmanship and passion.

Key Takeaways

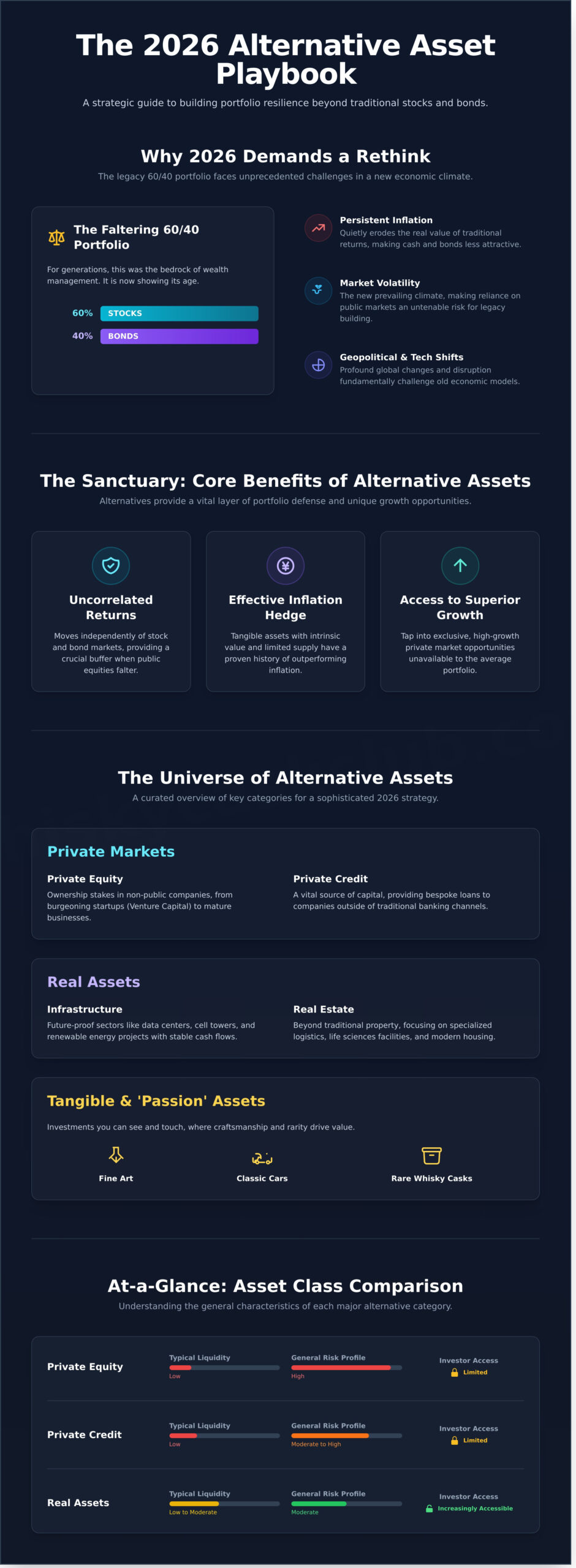

- Understand why the traditional 60/40 portfolio faces significant challenges and how alternatives provide a crucial path to genuine diversification.

- Develop a clear framework for your alternative asset investment 2026 strategy by defining your financial goals and long-term legacy objectives.

- Navigate the expanding universe of alternatives, from private markets to tangible ‘passion assets’ like fine art, classic cars, and rare whisky.

- Learn how to select tangible assets that align with both your personal passions and sophisticated investment criteria to build a truly personal portfolio.

Why 2026 Demands a Rethink of the Traditional Portfolio

For generations, the 60/40 stock-and-bond portfolio was the bedrock of wealth management. It was a simple, elegant strategy for a simpler time. However, the economic currents shaping the mid-2020s demand a more sophisticated and resilient approach. Persistent inflation, profound geopolitical shifts, and relentless technological disruption are fundamentally challenging the efficacy of this legacy model, compelling discerning investors to look beyond public markets.

The Shifting Economic Landscape Post-2024

The era of near-zero interest rates has decisively ended, ushering in a new paradigm where capital has a tangible cost and inflation quietly erodes the real value of traditional returns. This environment ensures that market volatility is no longer a rare storm but the prevailing climate. For those building a lasting legacy, relying solely on assets that falter in these conditions is an untenable risk.

Seeking Shelter: The Core Benefits of Alternatives

This is where a carefully curated alternative asset investment 2026 strategy provides a vital sanctuary. These tangible and often private assets operate with a logic independent of daily market sentiment. For those asking, what are alternative assets?, they represent a premier class of investments-from private credit and infrastructure to rare whisky casks-that offer a critical layer of portfolio defense and opportunity. Their value is rooted in a unique combination of pragmatic benefits.

- Uncorrelated Returns: The core appeal of alternatives is their ability to move independently of stock and bond markets. When public equities falter, these assets can hold their value or even appreciate, providing a crucial buffer.

- An Effective Inflation Hedge: Many alternative assets, particularly tangible ones with intrinsic value and limited supply, have a proven history of outperforming inflation, preserving and growing wealth in real terms.

- Access to Superior Growth: By moving beyond the confines of public markets, investors can tap into exclusive, high-growth opportunities unavailable to the average portfolio, making an alternative asset investment a cornerstone of modern wealth creation.

The Universe of Alternative Assets: A Curated Overview

For the discerning investor seeking to build a resilient portfolio, moving beyond traditional stocks and bonds is no longer an option-it is a strategic necessity. As we curate the most promising opportunities, a clear map of the expansive universe of alternative assets is essential. This landscape includes a diverse range of investments, each with unique characteristics of risk, return, and liquidity. Understanding these core categories is the first step toward crafting a sophisticated alternative asset investment 2026 strategy that aligns with long-term wealth preservation and growth.

Private Markets: Equity and Credit

Private markets offer direct access to the engines of the economy. Private equity involves taking ownership stakes in companies that are not publicly traded, from burgeoning startups (Venture Capital) to established, mature businesses. In parallel, private credit has become a vital source of capital, with funds providing bespoke loans to companies. While historically the domain of large institutions, access to these markets is gradually opening, offering accredited investors exclusive opportunities for significant capital appreciation.

Real Assets: Infrastructure and Real Estate

Real assets are tangible, physical properties that provide essential services and can generate stable, long-term cash flows. This goes far beyond traditional commercial real estate. In 2026, the focus is on future-proof sectors like digital infrastructure (data centers, cell towers), renewable energy projects, and specialized logistics facilities. These assets often provide an excellent hedge against inflation and are foundational to building a legacy portfolio grounded in the real economy.

Alternative Asset Class Comparison

| Asset Class | Typical Liquidity | General Risk Profile | Investor Access |

|---|---|---|---|

| Private Equity | Low | High | Limited (Accredited/Institutional) |

| Private Credit | Low | Moderate to High | Limited (Accredited/Institutional) |

| Real Assets | Low to Moderate | Moderate | Increasingly Accessible |

Setting the Stage for Tangible Luxury Assets

Beyond these established financial instruments lies a category of assets you can see, touch, and own directly. Unlike a share in a fund, these tangible luxury assets possess an intrinsic value rooted in craftsmanship, rarity, and cultural provenance. They represent a unique fusion of passion and pragmatism-investments that not only have the potential for appreciation but also carry a story and a heritage. This distinction is critical as we transition to the world of true passion investments.

The Rise of Tangible & Passion Assets for 2026

Beyond the digital and financial abstracts, a significant trend is emerging in the world of alternative investments: the return to the tangible. Passion assets are a unique class of investments where financial appreciation is intrinsically linked with personal interest and connoisseurship. For those crafting a sophisticated alternative asset investment 2026 strategy, categories like fine art, classic cars, luxury watches, and fine wine offer not only portfolio diversification but also the pride of ownership in something real, rare, and steeped in history.

Investing in Scarcity: Why Tangibles Thrive

The core value proposition of tangible assets lies in a simple economic principle: finite supply meeting growing demand. Unlike stocks or bonds, you cannot create another 1962 Ferrari 250 GTO. The value of such assets is powerfully enhanced by their provenance and heritage-the story behind the object. This documented history confirms authenticity and rarity, creating a legacy that discerning collectors and investors are willing to pay a premium for, ensuring its status as a store of value.

Liquid Legacies: The Case for Fine Wine & Rare Spirits

Liquid assets like fine wine have demonstrated remarkable resilience and performance, with indices like the Liv-ex 1000 consistently tracking their growth. The magic of these investments is that the aging process itself is a primary driver of value. As a vintage wine or spirit matures, its flavor profile develops, and its available quantity simultaneously dwindles through consumption. This creates a natural upward pressure on value, making distilled spirits in particular a uniquely stable and appreciating asset.

Spotlight on Whisky Casks: A Maturing Asset Class

Among passion assets, Scotch whisky casks represent a standout opportunity. Owning a cask is fundamentally different from owning a bottle; it is an investment in a living, breathing product. Its value increases through a combination of factors:

- Maturation: The spirit evolves inside the oak, gaining complexity and character each year.

- The Angel’s Share: A small amount of spirit evaporates annually, concentrating the remaining liquid and making it rarer.

- Age & Rarity: As the whisky becomes older, it enters a more exclusive and sought-after category.

Crucially, a whisky cask is a non-correlated asset, its value proposition insulated from the daily volatility of traditional financial markets. It offers a powerful combination of craftsmanship, heritage, and pragmatic growth. Discover the potential of owning a premium whisky cask.

Crafting Your 2026 Alternative Investment Strategy

Embarking on an alternative asset journey requires more than just capital; it demands a clear, disciplined strategy. Unlike traditional stocks and bonds, these markets are defined by unique characteristics like illiquidity and longer holding periods. A successful alternative asset investment 2026 portfolio is not built on speculation, but on a foundation of clear personal goals, a defined risk tolerance, and a patient, long-term perspective. This framework will guide your decisions and help you build a resilient, diversified portfolio designed for the future.

Determining Your Allocation and Time Horizon

Most financial advisors recommend allocating between 5-15% of a portfolio to alternatives. This allocation should be tailored to your specific timeline. An investment in a tangible asset like a rare whisky cask, for example, typically requires a 5-10 year commitment to allow for proper maturation and value appreciation. Balancing your portfolio between financial alternatives (like private credit) and tangible assets (like fine art or whisky) can provide both diversification and the unique satisfaction of owning a piece of craftsmanship.

The Crucial Role of Specialist Partners

Navigating the complexities of alternative assets without expert guidance is a significant risk. Specialist partners-from brokers and fund managers to custodians-provide essential expertise in sourcing, verification, and management. When vetting a potential partner, ask critical questions:

- What is your track record in this specific asset class?

- How do you ensure the asset’s provenance and secure storage?

- What are all associated management, insurance, and performance fees?

- What is your defined process for valuation and exit strategy?

For tangible assets with a deep heritage, such as rare whisky casks, a trusted partner like the Whisky Cask Club is indispensable for curating and managing your investment legacy.

Due Diligence Checklist for Tangible Assets

Thorough due diligence is non-negotiable. Before committing capital, verify the fundamentals of the asset. Your checklist should confirm the legal ownership and provenance, inspect the physical storage conditions, and clarify all associated costs, including insurance, management, and warehousing. Finally, ensure there is a clear, transparent process for independent valuation and a well-defined exit strategy for eventual liquidation. This meticulous approach protects your capital and positions your alternative asset investment 2026 for success.

The Whisky Cask Club: Your Partner in Building a Liquid Legacy

As discerning investors diversify their portfolios, the allure of tangible assets with a rich heritage continues to grow. For those considering a premier alternative asset investment 2026, Scotch whisky casks offer a compelling blend of craftsmanship and capital appreciation. Navigating this exclusive market, however, requires a trusted partner. The Whisky Cask Club stands as your definitive guide, transforming a passion for fine spirits into a sophisticated and secure investment. We provide curated access to the world’s most sought-after whisky casks, focusing not just on financial returns, but on building a tangible, liquid legacy for generations to come.

Exclusive Access to World-Class Distilleries

Our foundation is built upon deep-rooted relationships within the Scotch whisky industry. This allows us to source exceptional casks directly from iconic and emerging distilleries, ensuring impeccable provenance. We grant our members the rare opportunity to acquire a piece of Scotland’s liquid history-casks with the character and pedigree essential for significant maturation potential. This is more than an investment; it is ownership of true craftsmanship.

Seamless, Secure, and Fully Managed Ownership

We believe cask ownership should be a seamless and rewarding experience. Your asset is protected by a comprehensive, end-to-end management service that provides complete peace of mind. Every cask we source for our clients is:

- Stored Securely: Housed in UK government-bonded warehouses, ensuring optimal maturation conditions and protection from duty and VAT until bottling or removal.

- Fully Insured: Covered by a comprehensive insurance policy against theft, fire, and accidental damage.

- Expertly Managed: Overseen by our team, with regular reporting and portfolio reviews to track your asset’s performance.

Realizing Your Investment: A Clear Path to Exit

A successful investment requires a clear and strategic exit plan. The Whisky Cask Club provides expert guidance to help you realize your asset’s value at the optimal time. We assist clients in navigating various exit routes, including sales to other investors, transactions with independent bottlers, or the creation of a unique private bottling. Our commitment is to a transparent and profitable journey, ensuring your alternative asset investment matures as gracefully as the spirit within the cask. Discover how to begin your journey at whiskycaskclub.com.

Crafting Your Legacy: A Tangible Vision for 2026

As we look toward the financial landscape of 2026, it is clear that conventional portfolio strategies require a sophisticated evolution. The most discerning investors understand that tangible assets offer more than diversification; they provide a unique blend of passion, rarity, and potential appreciation. A successful alternative asset investment 2026 strategy is one built on provenance and expert guidance, moving beyond spreadsheets to secure something of real, lasting value.

At Whisky Cask Club, we specialize in transforming this vision into a tangible reality. We provide our members with exclusive access to premium, investment-grade Scotch whisky casks-a liquid legacy that matures in value over time. Our experts handle every detail, from sourcing rare casks and ensuring their security in government-bonded warehouses to providing clear, managed exit strategies. This is more than an investment; it is the beginning of a heritage.

Are you ready to explore an asset class defined by craftsmanship and history? Request a complimentary consultation to begin building your legacy portfolio.

Frequently Asked Questions: Alternative Asset Investments

What is the typical minimum investment for alternative assets like whisky casks?

The entry point for acquiring a premium whisky cask varies based on the distillery’s prestige, the age of the new make spirit, and the cask type. While highly sought-after casks command significant sums, a quality new-fill cask from a reputable distillery can typically be sourced starting from £4,000 to £7,000. This initial investment secures your ownership of a tangible asset with clear provenance, setting the foundation for your portfolio and legacy.

How are tangible assets like rare whisky casks valued over time?

A rare whisky cask’s value appreciates through a combination of maturation, rarity, and provenance. As the spirit ages, its flavour profile develops, increasing its intrinsic quality. Simultaneously, market demand for specific distilleries-particularly those with limited output or ‘silent stills’-drives scarcity. Reputable, independent valuations consider these factors, along with auction results for comparable casks, to determine a fair market price for your asset over time, reflecting its journey from spirit to a mature, sought-after whisky.

Are alternative investments regulated, and what protections do investors have?

The alternative asset market, including whisky casks, is not regulated in the same way as traditional financial services like stocks and shares. This makes due diligence paramount. Investor protection is established through clear proof of ownership-typically a certificate or delivery order-and by partnering with a trusted firm. We ensure every cask is stored securely in a government-bonded warehouse under your name, providing transparency and safeguarding your tangible asset from acquisition to exit.

How liquid is a whisky cask investment, and what is a realistic time horizon?

Whisky cask investment is a medium to long-term commitment, designed for patient capital growth. It is not a highly liquid asset. A realistic time horizon to allow for meaningful maturation and value appreciation is typically between 5 and 15 years. While exit opportunities exist through a network of brokers, auction houses, and independent bottlers, the process is more measured than public market trading. This deliberate pace is inherent to building a legacy through a tangible, maturing asset.

What are the main risks associated with alternative asset investments?

As with any portfolio addition, a prudent alternative asset investment 2026 strategy involves understanding the risks. These include market fluctuations affecting demand, the lack of direct financial regulation, and the physical nature of the asset (e.g., evaporation or ‘the angel’s share’). Mitigating these risks is achieved by working with experts who verify provenance, secure fully insured storage in bonded warehouses, and provide guidance on market trends, ensuring your investment is carefully managed.

Do I need to be a whisky expert to invest in a cask?

You do not need to be a whisky connoisseur to build a successful cask portfolio. Our role as your advisor is to provide the requisite expertise. We curate casks with excellent provenance and growth potential from our exclusive network of distilleries. Your focus remains on your investment goals, while we manage the intricate details of sourcing, storage, and valuation. This partnership allows you to participate in this exclusive market with confidence, blending passion with pragmatic financial strategy.