In the world of alternative investments, the quest for a reliable forecast is paramount. Many discerning investors begin their journey by searching for a whisky cask ROI calculator, hoping for a clear, definitive answer to a complex question: what will this tangible asset truly be worth? The reality, however, is that the very nature of a maturing spirit-a living product of wood, time, and craftsmanship-defies simple calculation. A basic formula cannot capture the nuances of a distillery’s provenance or the rarity of its liquid, often leading to the very uncertainty and fear of overpayment that investors seek to avoid.

This guide moves beyond those simplistic inputs. Here, we unveil the expert framework required to accurately project returns, empowering you to assess the critical variables that genuinely drive a cask’s long-term value. Forget the illusion of a simple calculator and instead, gain a sophisticated understanding of the principles behind a successful cask investment. Prepare to make your next acquisition with the quiet confidence that comes from building a legacy founded on both passion and pragmatism.

Key Takeaways

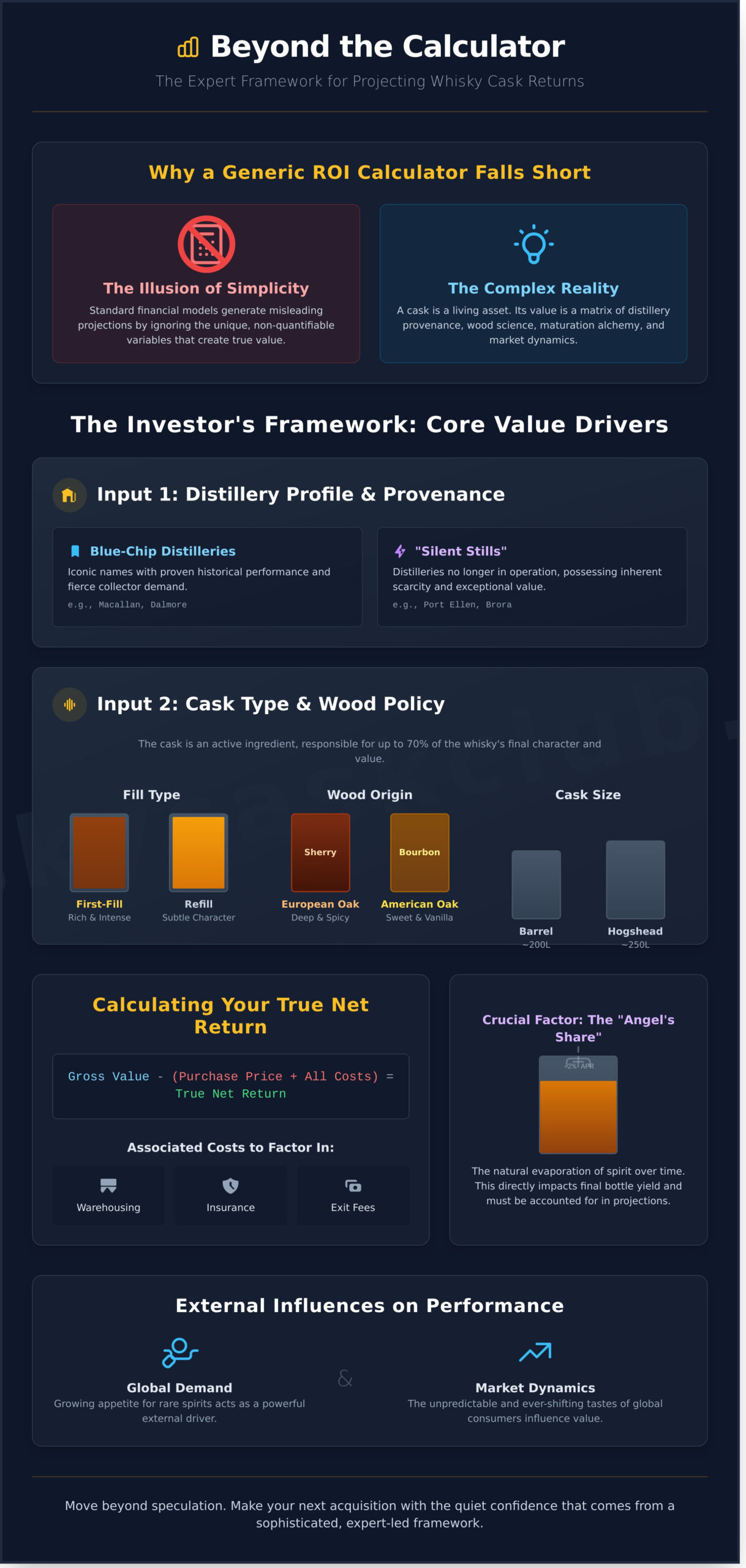

- Discover why a generic whisky cask ROI calculator falls short and learn the core variables you must analyze to project returns with authority.

- Learn the expert framework for evaluating a cask’s potential, focusing on critical factors like distillery provenance, age, and wood type.

- Understand how to calculate your true net return by identifying all associated costs, from warehousing and insurance to eventual exit fees.

- Recognize how wider market dynamics and global demand for rare spirits act as powerful external influences on your investment’s performance.

The Search for a Whisky Cask ROI Calculator: Allure and Limitations

In the world of tangible assets, the desire for predictive tools is natural. An investor, accustomed to forecasting stock market returns, understandably seeks a simple whisky cask ROI calculator to project the future value of their spirit. However, this search often leads to a fundamental misunderstanding of the asset itself. A cask of maturing whisky is not a number on a spreadsheet; it is a unique, living entity, shaped by wood, time, and the subtle alchemy of its warehouse environment.

While the allure of a one-click forecast is strong, the reality is that the most valuable assets defy simple calculation. True appreciation requires a deeper understanding of the craft and the market.

Why Standard Financial Calculators Don’t Apply

Unlike publicly-traded securities, a whisky cask’s value is governed by a complex matrix of factors that defy simple algorithms. The world of Scotch whisky as an alternative investment is influenced by unpredictable market trends and the ever-shifting tastes of global consumers. Furthermore, each cask possesses a unique ‘personality’ derived from its distillery’s provenance, the type of wood used, and its specific maturation conditions. These non-quantifiable elements-brand heritage, rarity, and the story behind the spirit-are what create exceptional value, and they cannot be captured by a standard financial model.

The Dangers of Misleading Projections

Relying on an oversimplified calculator can be more than just misleading; it can be detrimental to your investment strategy. These tools often generate overly optimistic projections by ignoring crucial variables. For instance, they may fail to account for the ‘Angel’s Share’-the natural evaporation of spirit from the cask over time-which directly impacts the final bottle yield and, therefore, the asset’s value. Making decisions based on such flawed data can lead to a poorly timed exit strategy, turning a promising investment into a significant disappointment.

It is crucial, then, to distinguish between a practical ‘bottling calculator,’ which can help estimate liquid volume, and a speculative ROI calculator. The former is a useful tool; the latter is often a fiction. True value projection requires a far more sophisticated framework. In the following sections, we will move beyond the search for a simplistic whisky cask ROI calculator and introduce the key pillars of a reliable analysis-one grounded in market intelligence, provenance, and expert evaluation.

The Investor’s Framework: Key Variables That Determine Cask Value

While our digital whisky cask ROI calculator provides a powerful projection, the most astute investors understand the mechanics behind the numbers. Consider this your manual framework-a guide to the fundamental inputs that dictate the future value of your tangible asset. Mastering these variables is not merely academic; it is the cornerstone of building a legacy through whisky. It is this deep understanding that separates a speculative purchase from a strategic investment, a critical distinction in a market that operates outside of FCA regulation, a point underscored by official police warnings on investment risks. Each variable interacts, creating a complex but predictable matrix of value appreciation.

Input 1: Distillery Profile and Provenance

The name on the cask is paramount. A distillery’s reputation, built over generations of craftsmanship, is its most significant asset. Casks from iconic, blue-chip distilleries like Macallan or Dalmore command a premium due to proven historical performance and fierce collector demand. Rarity is another powerful driver; spirit from “silent stills”-distilleries that are no longer in operation, such as Port Ellen or Brora-possesses an inherent scarcity that makes it exceptionally sought-after for both its flavour profile and investment potential.

Input 2: Cask Type and Wood Policy

The cask itself is not a passive container; it is an active ingredient responsible for up to 70% of the whisky’s final character and value. A first-fill cask, having held another spirit like sherry or bourbon only once, imparts a rich, intense flavour and is more valuable than a refill cask. The wood’s origin is equally critical: European Oak (often ex-sherry) imparts deep, spicy notes, while American Oak (typically ex-bourbon) offers sweeter, vanilla tones. Finally, size matters:

- Barrel (approx. 200 litres): Matures faster due to a higher wood-to-spirit ratio.

- Hogshead (approx. 250 litres): A versatile and common size for long-term aging.

- Butt (approx. 500 litres): Often sherry-seasoned, ideal for decades of maturation.

Input 3: Age, Maturation, and ‘The Sweet Spot’

A whisky cask’s value does not appreciate in a straight line. Its growth accelerates as it crosses key age milestones-10, 12, 18, and 25 years-when it can be legally bottled as a premium single malt of that age. Investing in ‘New Make Spirit’ offers the lowest entry point but requires the most patience. Conversely, acquiring a mature cask provides quicker potential returns. The art is identifying the optimal window to sell-the ‘sweet spot’-where the spirit has reached peak maturity and financial value, before the returns begin to diminish.

Beyond the Cask: Market Dynamics and External Influences

A cask of whisky is not an island. While its maturation is a quiet, solitary journey, its financial appreciation is deeply connected to the wider world. A discerning investor understands that the figures projected by a whisky cask ROI calculator are shaped by a complex tapestry of global trends, market sentiment, and industry prestige. True mastery of this tangible asset class lies in understanding these powerful external forces that can significantly impact your returns.

Your investment does not exist in a vacuum; it is part of a dynamic, global marketplace. By appreciating these influences, you move from being a passive owner to a strategic investor, capable of navigating the market with foresight and confidence.

Global Demand and Emerging Markets

The insatiable international appetite for premium Scotch whisky, particularly from the growing affluent classes in Asia and North America, is a primary driver of value. As palates become more sophisticated, specific styles-from heavily peated Islay malts to richly sherried Speyside spirits-can experience surges in demand. Astute investors monitor auction results and market reports, identifying these cultural shifts to anticipate which distilleries and cask profiles are poised for exceptional growth.

The Power of Scarcity and Rarity

Rarity is perhaps the most potent catalyst for value appreciation. Casks from ‘silent’ distilleries-revered names like Port Ellen or Brora that have closed their doors-possess an irreplaceable provenance, making them exceptionally sought-after assets. Similarly, a distillery’s strategic focus on limited edition bottlings can create a halo effect, elevating the perceived value and rarity of all its maturing stock and driving the secondary market for both bottles and casks.

Industry Awards and Critical Acclaim

Positive recognition acts as a powerful market signal. When a distillery wins a major international award, such as ‘Distillery of the Year,’ the resulting prestige can ignite a surge in global demand almost overnight. High scores from influential critics can similarly elevate a brand’s status, turning a well-regarded spirit into a must-have asset. For the serious investor, staying informed is not a hobby; it is a fundamental part of a successful strategy, providing context that a whisky cask ROI calculator alone cannot.

Calculating True ROI: Factoring in All Costs and Fees

A discerning investor understands that the final sale price of a whisky cask is only one part of the financial equation. The true measure of success is the net return on investment, a figure that can only be determined after accounting for all associated expenses. Gross profit can be misleading; it is the net return that truly defines the performance of your tangible asset. A sophisticated whisky cask ROI calculator must account for these variables to provide a realistic projection of your potential gains.

To build a legacy on a foundation of financial prudence, one must be meticulous. The journey of a cask, from distillery to liquidation, involves several key cost stages that are essential to factor into your financial modelling.

Initial Acquisition Costs

This is the foundational outlay for your investment. It is critical to have a clear understanding of all upfront charges before you commit. These typically include:

- The Cask Purchase Price: The principal investment in the new-fill spirit and the wood itself.

- Sourcing & Brokerage Fees: Compensation for the expertise required to locate and secure a premium cask with excellent provenance.

- Initial Verification: Costs for re-gauging, sampling, and condition reports to confirm the cask’s volume, strength, and quality from day one.

Ongoing Management Costs

For the years your whisky matures, your cask requires professional care to protect its value. These recurring costs are an integral part of nurturing your asset. They encompass:

- Annual Storage: Fees for warehousing your cask in a secure, government-bonded facility, which ensures optimal maturation conditions and defers duty payments.

- Comprehensive Insurance: Essential coverage that protects your investment against unforeseen events such as fire, theft, or damage.

- Periodic Health Checks: Optional but recommended fees for re-gauging or sampling to monitor the whisky’s maturation progress and quality.

Exit Strategy Costs

When your cask has reached its peak value and you are ready to realise your returns, a final set of costs will be incurred. Planning for these ensures there are no surprises at the most critical stage. These costs are variable depending on your chosen exit and may include:

- Brokerage or Auction Fees: A commission paid to the broker or auction house that facilitates the sale of your cask to another investor or collector.

- Bottling Costs: If you choose to bottle the whisky, this includes expenses for bottles, labels, corks, and labour.

- Capital Gains Tax: Depending on your jurisdiction, profits from the sale may be subject to taxation. We always advise consulting with a financial professional.

At Whisky Cask Club, we believe in complete transparency. Our experts provide a fully transparent cost structure to help you build your legacy with confidence. Request a consultation.

The Ultimate Calculator: Your Personal Investment Advisor

While a digital whisky cask ROI calculator provides a valuable starting point, it cannot capture the full spectrum of nuances that define this tangible asset class. The true potential of your investment is unlocked not by an algorithm, but by seasoned human expertise. An experienced advisor processes a complex tapestry of variables-distillery provenance, shifting market sentiment, and the subtle trajectory of a brand’s prestige-in a way that software simply cannot replicate.

This is the core of a managed approach: transforming raw data into an intelligent, forward-thinking strategy designed to build a legacy of value. It is the art and science of curating a portfolio that performs.

Building a Personalised Portfolio Strategy

Our process begins and ends with your unique objectives. A meticulously curated portfolio is more than a collection of assets; it is a direct reflection of your personal financial ambitions. We work with you to develop a bespoke plan that includes:

- Strategic Alignment: Matching cask age profiles and distillery characteristics to your specific risk tolerance and investment horizon.

- Intelligent Diversification: Spreading your investment across different regions, wood types, and maturation styles to mitigate risk and capture diverse growth opportunities.

- A Defined Exit Strategy: Establishing a clear plan for liquidation from day one, ensuring your investment journey has a purposeful and profitable destination.

Access to Exclusive Casks and Market Intelligence

Membership with the Whisky Cask Club grants you access to opportunities far beyond the public market. Our deep-rooted industry relationships allow us to source rare and high-potential casks directly from Scotland’s most revered distilleries-casks that are never offered to the general public. We leverage proprietary market data to inform every acquisition, ensuring each cask is vetted for quality, provenance, and long-term potential. From navigating the complexities of ownership and bonded storage to managing the final sale, our experts guide you at every step.

Ultimately, this managed approach elevates cask ownership from a simple transaction into a sophisticated investment. It is the crucial difference between using a simple calculator and partnering with a dedicated advisor to build a truly exceptional portfolio. Speak with one of our advisors today to begin crafting your personal whisky legacy.

Beyond the Calculator: Crafting Your Whisky Legacy

The journey into cask investment reveals a crucial truth: a successful strategy is built not on algorithms, but on insight. While a digital whisky cask ROI calculator offers a preliminary glimpse, it cannot capture the nuanced variables of provenance, market dynamics, and the intrinsic quality of a truly rare spirit. The most reliable framework for projecting returns combines a deep understanding of this tangible asset with expert guidance that navigates the complexities of the market and accounts for every cost.

This is where passion meets pragmatism. The ultimate calculator is a partnership with a trusted advisor. At the Whisky Cask Club, we provide this essential expertise, offering our members exclusive access to rare, investment-grade casks, supported by expert portfolio management. Your asset is secured in fully insured, Scottish bonded warehouses as it matures into a legacy.

Move beyond generic projections and begin building a portfolio with genuine potential. Schedule a consultation to build your personal cask investment strategy.

Frequently Asked Questions

What is a realistic annual return on investment for a whisky cask?

While past performance is not a guarantee of future results, well-chosen casks from distilleries with strong provenance have historically demonstrated average annual returns of 8-12%. This appreciation is driven by the spirit’s age, rarity, and the distillery’s reputation. A rare single malt from a prestigious producer will command a higher potential return than a more common grain whisky. Our curated approach focuses on sourcing casks with the strongest potential for appreciation.

How long should I plan to hold a whisky cask to see the best ROI?

Whisky cask ownership is a long-term investment strategy. We advise our clients to plan for a holding period of 8 to 12 years, or longer. This timeframe allows the spirit to mature significantly, crossing important age-statement thresholds (e.g., 10, 12, 18 years) which can dramatically increase its value and rarity. Patience is fundamental to unlocking the full potential of this unique, tangible asset and building a true legacy.

Are there significant hidden costs I should factor into my ROI calculation?

Transparency is paramount to a successful investment. The primary ongoing costs are annual storage and insurance, which are essential to protect your asset in a government-regulated bonded warehouse. While these fees are typically modest, they must be factored into any serious financial projection. A comprehensive whisky cask ROI calculator should always account for these variables, as well as any potential brokerage fees upon exit, to provide a truly accurate forecast of net returns.

How does the ‘Angel’s Share’ impact the final ROI of my cask?

The ‘Angel’s Share’ is the natural evaporation of spirit from the cask over time, typically around 2% per year initially and decreasing as the whisky ages. While this reduces the total volume of liquid, it also concentrates the flavours and often increases the alcohol by volume (ABV). This process is essential to maturation and contributes to the spirit’s quality and rarity, thereby positively influencing its final value despite the loss in volume.

Is it possible to lose money on a whisky cask investment?

As with any tangible asset, there are inherent risks, and it is possible for a cask’s value to stagnate or decline. However, this is historically rare for well-sourced casks from reputable distilleries. The key to mitigating risk lies in expert selection and provenance. Our meticulous curation process, focused on casks with strong brand heritage and global demand, is designed to safeguard your capital and target consistent, long-term appreciation for your portfolio.

How do I calculate the final number of bottles from my cask?

To estimate the number of bottles, you need the cask’s final volume in litres and its Alcohol By Volume (ABV). First, calculate the total litres of pure alcohol (Volume in Litres x ABV %). Then, divide this figure by the alcohol volume per bottle. For a standard 70cl bottle at 46% ABV, the alcohol volume is 0.322 litres (0.70 x 0.46). For example, 150 litres at 55% ABV would yield approximately 256 bottles.