In an era defined by market volatility and the silent erosion of inflation, the prudent investor seeks more than digital promises. The conventional portfolio, heavily weighted in stocks and bonds, often feels exposed, lacking the substance required to truly weather financial storms. For centuries, discerning individuals have anchored their wealth not in fleeting market trends, but in items of intrinsic value and rarity. This is the enduring appeal of tangible asset investments-a sophisticated strategy where craftsmanship, provenance, and scarcity create a powerful hedge against uncertainty and build lasting financial security.

Yet, this world can seem opaque, reserved for an exclusive few. How do you distinguish a fleeting trend from a truly valuable asset? This guide serves as your trusted advisor, demystifying the landscape of tangible wealth. We will explore the principles for identifying and evaluating premium opportunities, from rare whisky casks to fine art and beyond. You will discover how to diversify your holdings with confidence, protect your capital, and begin building a personal legacy with assets of genuine substance and character.

Key Takeaways

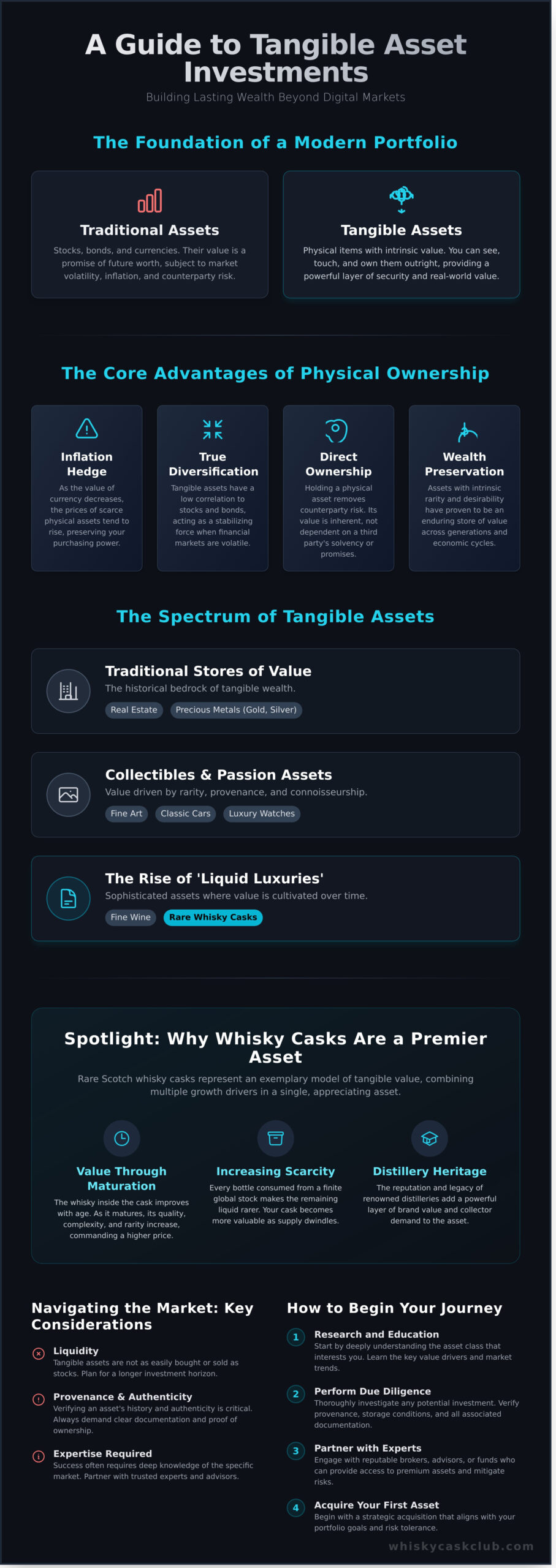

- Understand how physical assets, from precious metals to fine art, can provide a layer of security that traditional financial markets may lack.

- Discover the unique characteristics that make certain passion investments, like rare Scotch whisky casks, an exemplary model for tangible value and growth.

- Navigate the common challenges of tangible asset investments, including liquidity and provenance, with expert strategies for mitigating risk.

- Gain a clear, step-by-step framework for beginning your journey, from initial research and due diligence to acquiring your first premium asset.

What Are Tangible Asset Investments? The Foundation of a Modern Portfolio

In a world dominated by digital ledgers and market fluctuations, tangible assets represent a return to fundamental value. Unlike stocks or bonds, which are essentially promises of future worth, a tangible asset is a physical item with intrinsic value-something you can see, touch, and own outright. Think of the aged wood of a rare whisky cask, the deed to a prime piece of real estate, or the luster of a gold coin. These tangible asset investments form the bedrock of a truly diversified portfolio, prized for their resilience, historical performance, and enduring appeal as a store of value.

Their primary role is to provide stability and wealth preservation. Because their value is often driven by different economic forces than those affecting financial markets, they typically exhibit a low correlation to stocks and bonds, making them a powerful tool for sophisticated investors seeking to build a robust and balanced portfolio.

The Power of Physical Ownership

The ultimate security lies in direct ownership. A tangible asset held in your possession or securely in your name removes counterparty risk-the danger that a financial institution or other party will fail to meet its obligations. Unlike currencies that can be printed or shares that can be diluted, a rare tangible asset is finite. This physical control and inherent scarcity provide a profound sense of security and psychological comfort that digital assets simply cannot replicate.

A Strategic Hedge Against Inflation

As inflation erodes the purchasing power of currency, tangible assets have historically proven to be a formidable shield. Their prices, rooted in scarcity and real-world demand, tend to rise alongside the general cost of living. When central banks expand the money supply, the value of cash declines, but assets like property, precious metals, and fine art cannot be created from thin air. This inherent scarcity has allowed them to preserve wealth and generate significant real returns during periods of high inflation.

Diversification Beyond Wall Street

A cornerstone of intelligent portfolio management is diversification, and tangible assets offer a crucial advantage: low correlation to traditional financial markets. This means they often perform well when Wall Street falters, acting as a stabilizing force that can smooth out returns over the long term. The broad spectrum of Tangible investment opportunities allows savvy investors to build resilience and reduce overall portfolio volatility. Incorporating these real assets is a strategic move to insulate a portion of one’s wealth from the unpredictable nature of public markets.

The Spectrum of Tangible Assets: From Precious Metals to Passion Investments

The world of tangible asset investments extends far beyond simple physical ownership. While the formal definition of a Tangible Asset often brings to mind property or industrial equipment, the modern portfolio embraces a spectrum of items with intrinsic value. This landscape ranges from the bedrock of traditional wealth preservation to exclusive assets that offer returns measured in both financial appreciation and personal enjoyment, creating a legacy you can see and touch.

Traditional Stores of Value: Real Estate & Precious Metals

For generations, two categories have formed the foundation of tangible wealth. Real estate offers the potential for rental income and capital growth, though it demands significant capital and active management. Precious metals like gold and silver are prized for their high liquidity and status as a ‘safe-haven’ asset during economic volatility, acting as a reliable, globally recognized store of value and the historical bedrock of tangible investing.

Collectibles & Passion Assets: Art, Classic Cars, and Watches

Venturing further reveals assets driven by passion and provenance. Fine art, classic cars, and rare luxury watches are not merely possessions; they are culturally significant artifacts whose value is dictated by rarity, condition, and collector demand. Success in this realm requires deep expertise to navigate authenticity and market trends, making it the domain of the true connoisseur who appreciates the story behind the asset as much as its potential return.

The Rise of ‘Liquid Luxuries’: Fine Wine & Whisky Casks

A more accessible yet equally sophisticated category has emerged in ‘liquid luxuries.’ Fine wine and premium whisky casks represent a growing investment class where value is cultivated over time. Driven by scarcity as stock is consumed, the maturation process, and the heritage of renowned producers, these assets offer a compelling blend of craftsmanship and financial potential. They provide a unique entry into the world of passion investing. Intrigued by passion assets? Discover the potential of whisky cask investment.

A Case Study in Tangible Value: Why Whisky Casks Are a Premier Asset

To truly understand the power of tangible asset investments, one must look at an asset class where value is created through a physical, time-honored process. Among the most compelling examples is the Scotch whisky cask, an asset that embodies the core principles of rarity, craftsmanship, and intrinsic worth. It is more than a commodity; it is a legacy in liquid form, appreciating through a process that cannot be rushed or replicated.

The Principle of Maturation and Scarcity

Unlike many assets, a whisky cask’s value is intrinsically linked to the passage of time. As the spirit rests in oak, it develops complexity, colour, and character-maturing from a raw spirit into a premium, sought-after liquid. Simultaneously, a small amount evaporates each year in a process poetically known as the “Angel’s Share.” This natural reduction ensures that older whisky is not only better but also significantly rarer, creating a powerful dynamic where improving quality and increasing scarcity drive appreciation.

Unwavering Global Demand and Provenance

The global appetite for premium, aged Scotch is robust and growing. This demand is met by a finite supply, protected by law: Scotch whisky can only be produced and matured in Scotland. This creates a formidable geographic moat, safeguarding its exclusivity. Furthermore, the value is deeply tied to its provenance-the reputation and heritage of the source distillery. Owning a cask from a celebrated producer is to own a piece of a legacy, a story of craftsmanship recognized worldwide.

A Market Independent of Financial Fluctuations

A defining feature of whisky casks is their non-correlation with traditional financial markets. The value of a maturing cask is dictated by its age, rarity, and industry demand, not by stock market indices or geopolitical volatility. Historical data consistently demonstrates the stable, long-term growth of the rare whisky market, positioning it as a powerful diversification tool. For investors seeking to build a resilient portfolio, this asset offers a source of returns insulated from the whims of Wall Street, making it one of the most intelligent tangible asset investments available.

Evaluating Tangible Investments: Key Risks and Considerations

A sophisticated approach to tangible asset investments requires a clear understanding of their unique characteristics. While offering unparalleled stability and the potential for significant appreciation, physical assets present challenges that differ from traditional financial instruments. Acknowledging these considerations is the first step toward building a resilient and rewarding portfolio. These are not barriers, but areas where meticulous planning and professional guidance are paramount.

The Challenge of Liquidity and Exit Strategies

Tangible assets are inherently less liquid than stocks or bonds; they cannot be sold with the click of a button. A successful investment journey, therefore, must begin with the end in mind. A clear exit strategy is essential. Common avenues include:

- Private Sale: Direct transactions with other collectors or investors.

- Auction Houses: Access to a global market of discerning buyers, though commissions can be high.

- Specialist Brokerages: A curated marketplace offering expertise and a network of qualified buyers.

For example, the Scotch whisky cask market benefits from a network of brokers who create a fluid marketplace, connecting sellers with buyers and streamlining the entire divestment process.

Understanding Storage, Insurance, and Provenance

Owning a physical object of value involves logistical responsibilities. Secure storage, specialized insurance, and impeccable documentation of provenance are non-negotiable. These elements protect the asset’s physical integrity and its market value. The world of whisky casks offers an elegant solution: casks are typically stored in government-bonded warehouses in Scotland. This highly regulated environment provides optimal maturation conditions, robust security, and comprehensive insurance, all managed by industry professionals, removing the burden from the owner.

The Critical Importance of Expert Guidance

Navigating the nuances of niche markets is perhaps the most significant challenge for new investors. Authentication, valuation, and forecasting trends demand deep specialist knowledge. Without it, an investor is exposed to the risks of fraud, overpayment, and acquiring an asset with limited potential. This is where a trusted advisor becomes indispensable. A firm like the Whisky Cask Club acts as both a gatekeeper and a guide, leveraging its expertise to source, verify, and manage premium assets. We ensure that every investment is not only authentic but also aligned with your ambition to build a lasting legacy.

How to Begin Your Journey in Tangible Asset Investing

Embarking on your journey into the world of tangible assets is a significant step toward building a resilient and diversified portfolio. While the path to acquiring rare art, fine wine, or premium whisky casks can seem exclusive and complex, a deliberate, structured approach ensures both clarity and confidence. This framework is designed to demystify the process, transforming aspiration into a tangible reality and setting a firm foundation for successful tangible asset investments.

Step 1: Define Your Goals and Allocation

Clarity of purpose is paramount. Before you begin, define your primary objective. Are you seeking long-term capital growth, a robust hedge against inflation, or are you pursuing a passion that also serves as a store of value and legacy? Once your goal is clear, determine a prudent allocation. For most investors, dedicating 5-10% of their overall portfolio to alternative assets is a balanced approach. Finally, align this strategy with your timeline, as many tangible assets require patience to mature and realize their full potential.

Step 2: Research and Due Diligence

Knowledge is your greatest asset in this specialized field. Before committing capital, you must immerse yourself in the specific asset class that captures your interest. Diligently research its market drivers, historical performance, and the key factors that determine value, such as provenance, condition, and rarity. A meticulous analysis of potential returns against all associated costs-including acquisition fees, storage, insurance, and eventual commissions-is essential for making an informed and strategically sound decision. This diligence separates a hobbyist from a serious investor.

Step 3: Partner with a Trusted Specialist

Navigating these exclusive markets is rarely a solitary endeavor. A trusted specialist, whether a reputable dealer, broker, or managed fund, provides invaluable expertise and secure access to premium, often off-market, opportunities. It is crucial to verify their credentials, track record, and commitment to transparency. The right partner acts as a discreet advisor, managing the intricate complexities of sourcing, authentication, secure storage, and eventual liquidation on your behalf, allowing you to invest with confidence. To begin this conversation and explore your strategy, Schedule a consultation to explore your tangible asset strategy.

Forge Your Legacy with Tangible Value

In an ever-fluctuating digital market, tangible assets offer a grounding force, providing both portfolio diversification and a connection to items of real, enduring worth. From the steadfast security of precious metals to the rich heritage found in passion investments, the key to success lies in diligent evaluation and strategic selection. Embarking on a journey into tangible asset investments is not merely about financial returns; it is about acquiring assets with provenance, craftsmanship, and a story that appreciates over time.

Among the most compelling of these assets are rare Scotch whisky casks, an investment that matures in both character and value. At Whisky Cask Club, we provide discerning investors with exclusive access to casks from world-renowned Scotch distilleries. Your investment is secured in government-regulated bonded warehouses, and our team offers expert portfolio management and clear exit strategy guidance to ensure your legacy is both protected and profitable.

Ready to build a legacy with a truly tangible asset? Explore our exclusive whisky cask investment opportunities.

The journey to a more resilient and meaningful portfolio begins with a single, deliberate step. Take yours today.

Frequently Asked Questions

What is the typical minimum investment for tangible assets?

The entry point for tangible asset investments varies significantly by the specific asset class. While fine art or classic cars often require substantial capital, more accessible avenues exist. For instance, acquiring a premium, newly-filled whisky cask can begin from a few thousand pounds. This presents a curated opportunity for investors to secure a high-calibre asset with a manageable initial outlay, forming a strong foundation for a diversified portfolio focused on long-term growth.

Are tangible asset investments liquid?

Tangible assets are characteristically illiquid. Unlike stocks or bonds, they cannot be instantly converted to cash on a public exchange. The process of selling involves finding a qualified buyer, verifying provenance, and completing the legal transfer of ownership, which can take time. This deliberate pace is intrinsic to the asset class, rewarding patient investors who are focused on significant capital appreciation over a longer holding period rather than immediate liquidity.

How are tangible assets like whisky casks taxed upon sale?

In the UK, a maturing whisky cask is typically classified by HMRC as a ‘wasting asset,’ as its predictable life is considered to be under 50 years. Consequently, the profit realised from the sale by a private individual is generally exempt from Capital Gains Tax (CGT). This tax efficiency is a considerable advantage for investors. As tax legislation can be complex and subject to change, we always recommend seeking professional advice from a qualified financial advisor.

What are the main differences between investing in a whisky cask versus a rare bottle?

Investing in a cask is an investment in the maturation process itself. Its value is created as the spirit ages, develops complexity, and becomes rarer over time. A rare bottle, by contrast, is a finished product whose value is driven by secondary market demand, brand prestige, and existing scarcity. Cask ownership is about cultivating and creating future value, whereas bottle collecting is about trading a static asset whose primary value has already been realised.

How do I verify the authenticity and ownership of a tangible asset?

Verifying provenance and legal title is paramount. For whisky casks, ownership is proven with a Certificate of Ownership or a formal Delivery Order in your name. It is essential that the cask is held in a government-regulated bonded warehouse, which provides an indisputable record of its existence and location. We ensure all documentation is in order and can facilitate independent reports to confirm the cask’s volume and strength, guaranteeing the integrity of your asset.

What kind of returns can be expected from tangible assets?

While returns are never guaranteed, high-quality tangible asset investments have a strong history of delivering significant capital appreciation. Asset classes like rare whisky have consistently been top performers in luxury investment indices, often outpacing traditional financial markets. The potential for strong returns, combined with their ability to act as a hedge against inflation, makes them a compelling choice for investors seeking to build a legacy and diversify their wealth.