The world of whisky cask investment is shrouded in mystique-a realm of rare spirits, remarkable returns, and tangible luxury. Yet, for many aspiring investors, this allure is tempered by uncertainty. The landscape can seem clouded by complex valuations, opaque processes, and the ever-present risk of fraudulent brokers. The prospect of investing in whisky barrels feels both exhilarating and daunting, a tangible asset where passion meets portfolio, but where clarity is paramount to success.

This guide is crafted to dispel that ambiguity. Here, you will master the art of this exclusive investment, gaining the confidence to navigate the market with precision. We will illuminate the entire journey, from understanding the key drivers of a cask’s value-its provenance, age, and distillery heritage-to identifying a reputable partner and managing your asset from purchase to profit. Prepare to build your own liquid legacy, transforming a passion for fine craftsmanship into a sophisticated and rewarding financial future.

Key Takeaways

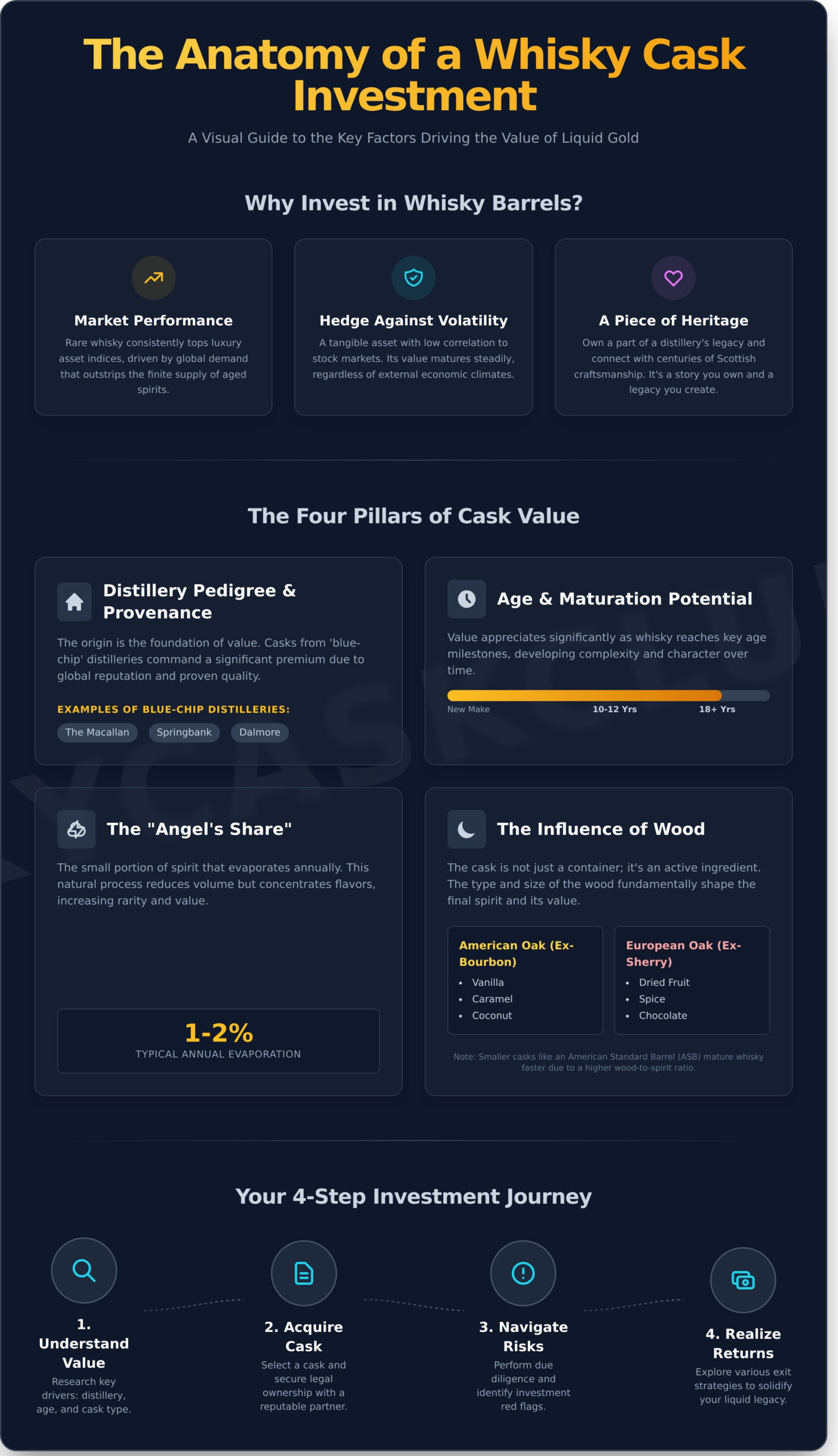

- Understand the key drivers of a cask’s value, from distillery provenance to the craftsmanship of the wood, to make more informed investment decisions.

- Discover a clear, step-by-step process for acquiring your first whisky cask, from initial research and selection to securing legal ownership.

- Successfully navigate the common risks associated with investing in whisky barrels by learning how to identify critical red flags and perform proper due diligence.

- Master the final phase of your investment by exploring the various exit strategies available to realize returns and solidify your liquid legacy.

Why Invest in Whisky Barrels? The Allure of a Tangible Asset

For the discerning investor, diversifying a portfolio means looking beyond traditional stocks and bonds. Whisky cask investment has emerged as a premier alternative asset class, offering a unique blend of financial pragmatism and personal passion. This is not merely a transaction; it is the acquisition of a tangible asset with deep provenance and a compelling growth trajectory. By investing in whisky barrels, you are securing a piece of liquid history that matures in both character and value over time.

Market Performance and Growth Potential

The historical performance of rare whisky is a testament to its enduring appeal. Over the past decade, rare whisky has demonstrated remarkable growth, frequently topping luxury asset indices. This performance is driven by a fundamental economic principle: global demand for premium, aged Scotch consistently outstrips the finite supply. As a cask of new-make spirit ages, it undergoes a transformative process within the oak, a critical element in understanding what is Scotch whisky. This natural maturation inherently enhances its quality, rarity, and, consequently, its financial worth, creating a predictable path to value appreciation.

A Hedge Against Traditional Market Volatility

In a world of digital assets and fluctuating markets, owning a physical whisky cask offers profound security. This tangible asset’s value has a very low correlation with the performance of stock and bond markets. Economic downturns do not halt the aging process; the liquid gold within your cask continues to mature and improve, regardless of external financial climates. This inherent stability positions cask ownership as a powerful hedge against inflation and an intelligent method for diversifying and protecting wealth for the long term.

The ‘Passion’ Investment: Owning a Piece of Heritage

Beyond the impressive returns, investing in whisky barrels connects you to centuries of Scottish craftsmanship and heritage. It is an opportunity to own a piece of a legendary distillery’s story, a direct link to the artisans who practice a time-honoured craft. This is more than an asset on a balance sheet; it is the chance to curate a personal collection and build a lasting legacy. Whether held for future bottling, passed to the next generation, or sold at peak maturity, a whisky cask is a story you own and a legacy you create.

The Anatomy of a Cask Investment: Key Factors That Drive Value

To the discerning investor, a whisky cask is not merely a container of maturing spirit; it is a tangible asset whose value is dictated by a precise combination of factors. Understanding these elements is fundamental to the art of investing in whisky barrels, as not all casks are created with equal potential for growth. The interplay between the distillery’s heritage, the spirit’s age, and the character of the wood itself determines both present and future worth.

The Distillery’s Pedigree and Provenance

The foundation of a cask’s value lies in its origin. Casks from ‘blue-chip’ distilleries-names like The Macallan, Springbank, or Dalmore-command a significant premium due to their global reputation for exceptional quality, consistency, and desirability. A distillery’s heritage is built on decades of proven craftsmanship, and its provenance is a non-negotiable aspect of its value. This is why the process of verifying your whisky cask through official channels like the UK’s Spirit Drinks Verification Scheme is a critical step in securing your investment and guaranteeing its authenticity.

Age, Maturation Potential, and the ‘Angel’s Share’

A cask begins its life filled with ‘New Make Spirit,’ a clear and potent liquid. Its journey toward becoming a valuable asset is measured in time. As the whisky ages, it develops complexity and character, with value appreciating significantly as it reaches key milestones such as 10, 12, or 18 years. During this time, a small portion of the spirit-typically 1-2% per year-evaporates through the porous oak. This romantic phenomenon, known as the ‘Angel’s Share,’ reduces the total volume but concentrates the remaining liquid, intensifying its flavour and rarity.

The Influence of Wood: Cask Types and Sizes

The cask itself is the vessel of transformation, and its specific characteristics are paramount. The most influential factors include:

- Wood Type: American Oak, typically ex-bourbon, imparts notes of vanilla, caramel, and coconut. European Oak, often seasoned with Sherry, delivers richer, spicier notes of dried fruit and chocolate.

- Cask Size: A smaller American Standard Barrel (ASB) matures whisky more quickly than a larger Sherry Butt due to a higher wood-to-spirit ratio. Hogsheads, often constructed from the staves of bourbon barrels, offer a balance between the two.

- Previous Contents: A cask’s history profoundly shapes the final spirit. Whether it previously held Oloroso Sherry, Pedro Ximénez, or American Bourbon, these residual flavours become integral to the whisky’s unique profile and investment appeal.

Your Step-by-Step Guide to Acquiring a Whisky Barrel

Embarking on the journey of investing in whisky barrels is a meticulous process, but it need not be complex. For the discerning investor, acquiring a cask of rare, maturing spirit is a tangible step towards building a lasting legacy. This guide provides a clear roadmap, transforming an aspirational goal into a tangible reality through three distinct stages, ensuring your acquisition is both secure and rewarding.

Step 1: Define Your Investment Strategy

A successful investment begins with clear intent. First, establish your objectives: are you seeking long-term capital appreciation over a decade or more, or a shorter hold period? Next, determine a realistic budget that accounts not only for the cask itself but also for associated costs like insurance and annual storage. Finally, research the distilleries, regions, and wood types that align with your personal interest and portfolio goals-from the robust, peated spirits of Islay to the elegant, fruity character of a classic Speyside.

Step 2: Select a Reputable Cask Broker

Navigating the cask market requires expertise and access. A distinguished broker acts as your trusted advisor, sourcing casks with impeccable provenance and shielding you from the market’s pitfalls. In a space where UK authorities warn of fraudulent activity, this partnership is non-negotiable. When vetting a potential partner, ask critical questions:

- What is your experience in the industry and what are your distillery connections?

- How do you verify the cask’s history and ownership?

- Can you provide a full breakdown of all costs, including ongoing management fees?

Your goal is to choose a partner committed to transparency and your long-term success, not just a seller focused on a single transaction.

Step 3: The Purchase and Transfer of Ownership

Once you have selected a cask, the transfer of ownership is a precise and secure process. The most critical document is the Delivery Order, which serves as the title deed to your cask. Upon receipt of your secure payment, this order is sent to the bonded warehouse where the cask is stored. The warehouse keeper then updates their records, officially transferring legal ownership to your name. You will receive documentation confirming you are the sole, verified owner of the cask and its precious, maturing liquid. Your journey in investing in whisky barrels is now officially underway.

Ready to take the first step? Request a consultation to discuss your investment goals.

The Maturation Journey: Secure Storage and Asset Management

Once you acquire your cask, the journey of transformation begins. This is not a passive waiting period; it is the active and crucial phase where your spirit develops its character and your tangible asset accrues its value. The success of investing in whisky barrels hinges on meticulous post-purchase management. From secure storage to comprehensive insurance and regular performance monitoring, every detail is professionally handled to protect and enhance your investment, ensuring your legacy is in expert hands.

Understanding HMRC Bonded Warehouses

Your cask is stored in a secure, government-regulated HMRC bonded warehouse. This is a highly controlled environment with optimal conditions for maturation-cool, dark, and stable. The most significant advantage is financial: your whisky is held ‘in bond’, meaning that UK VAT and Duty are suspended. These taxes are only payable if and when the whisky is bottled and removed for consumption in the UK, preserving the cask’s value as a tradable asset.

Comprehensive Insurance: Protecting Your Legacy

A tangible asset of this calibre demands uncompromising protection. Every cask we manage is protected by a comprehensive insurance policy for its full replacement value, safeguarding your legacy against the unforeseen. We manage all aspects of the policy on your behalf, providing complete peace of mind. This essential cover includes protection against:

- Fire, flood, and other elemental damage

- Theft and malicious damage

- Accidental damage during warehouse handling

Monitoring Your Cask’s Progress and Valuation

An essential part of managing your asset is tracking its evolution. We conduct periodic ‘re-gauging’ to measure the cask’s volume and Alcohol by Volume (ABV), accounting for the natural evaporation known as the ‘Angel’s Share’. You will receive regular valuation updates and market analysis, providing a clear picture of your asset’s performance. For the true connoisseur, we can even arrange for samples to be drawn, allowing you to taste the remarkable development of your own spirit.

This diligent oversight ensures that your journey into investing in whisky barrels is not only rewarding but also transparent and secure. Our comprehensive management service transforms a simple purchase into a carefully curated investment, allowing you to focus on the pleasure of ownership while we focus on maximising its potential.

Navigating the Risks and Identifying Investment Red Flags

A prudent investor is an informed investor. While the allure of cask ownership is undeniable, a core principle of successful investing in whisky barrels is a clear understanding of the associated risks. At the Whisky Cask Club, we believe transparency is paramount to building a lasting legacy. Acknowledging the potential pitfalls is the first step toward avoiding them and securing a truly premium asset.

Common Scams and How to Avoid Them

The growing interest in whisky has unfortunately attracted unscrupulous actors. A discerning investor must be vigilant. Be wary of any company that employs high-pressure sales tactics or makes unsolicited contact. True luxury assets do not require such aggressive promotion. Key red flags include:

- Unsolicited Cold Calls: Reputable brokers do not engage in cold calling. Your journey should begin with your own research and inquiry.

- ‘Guaranteed’ Returns: Whisky is a market-driven asset. Any promise of guaranteed or impossibly high short-term returns is a significant warning sign.

- Vague Ownership: Insist on seeing and verifying all ownership documentation, such as a formal delivery order or certificate of title, before any funds are exchanged. This is non-negotiable.

Understanding Liquidity and a Long-Term Horizon

Unlike stocks or bonds, a whisky cask is a tangible, illiquid asset. It cannot be sold in an instant. The process of finding a buyer, whether an independent bottler or another collector, takes time. This investment demands patience, mirroring the maturation process of the spirit itself. Investors should be prepared for a holding period of at least 5-10 years to allow the whisky to appreciate meaningfully in both character and value.

Accounting for All Costs: Beyond the Purchase Price

The initial acquisition cost is only the beginning of your financial commitment. A comprehensive understanding of the total cost of ownership is essential for accurately projecting your potential returns. A transparent partner will always provide a clear, itemized breakdown of all ongoing fees, which typically include:

- Annual storage costs at a secure, government-bonded warehouse.

- Comprehensive insurance to protect your asset against loss or damage.

- A broker’s commission or management fee upon the eventual sale of your cask.

Navigating this landscape with a trusted advisor ensures your focus remains where it should be: on the craft, the heritage, and the long-term growth of your tangible asset. To learn more about our commitment to transparency and provenance, we invite you to explore our process at whiskycaskclub.com.

The Exit Strategy: How to Realize Returns on Your Whisky Barrel

The patient art of maturation culminates in one critical moment: realizing the value of your asset. This final phase of your investment is where potential transforms into tangible profit. The path you choose depends on your personal goals, but navigating it with an expert advisor is paramount. A well-managed exit strategy is the key to success when investing in whisky barrels, ensuring you capitalize on your cask’s peak value at the opportune moment.

Your dedicated broker provides invaluable guidance, offering access to a network of buyers and advising on the optimal time to sell based on market conditions and the maturity of your spirit. Several distinct avenues are available to you.

Selling to Another Private Investor or Collector

The most direct and common route to realizing your returns is through the thriving secondary market. Here, your mature cask is sold to another discerning investor or collector seeking a premium, aged asset with clear provenance. Our role as your broker is to facilitate this entire process, from valuation to the secure transfer of ownership, providing you with a seamless and profitable exit.

Selling to an Independent Bottler

Independent bottlers are the curators of the whisky world, celebrated for sourcing and releasing rare, single-cask expressions. They are constantly searching for unique casks with exceptional character to add to their exclusive portfolios. Through our established industry network, we connect your cask with these prestigious buyers, who often pay a premium for a spirit that fits their brand’s profile.

The Ultimate Goal: Bottling Your Own Whisky

For the ultimate personal return, you can choose to bottle the spirit you have carefully matured. This path transforms your tangible asset into a unique personal legacy-a whisky that is exclusively yours. While this involves additional steps such as bottling, custom labeling, and paying duties, the result is a deeply rewarding expression of your investment journey, perfect for corporate gifting, special events, or personal enjoyment.

Your exit strategy is as unique as your cask. Whether your goal is a straightforward financial return or the creation of a personal brand, the Whisky Cask Club provides the expert guidance necessary to navigate this final step with confidence. To discuss your investment goals and begin building your legacy, contact our specialists today.

The Final Pour: Securing Your Whisky Investment Legacy

As we’ve explored, the world of whisky cask ownership offers a unique union of passion and portfolio diversification. It is an investment in a tangible asset, where value is cultivated through time, craftsmanship, and provenance. Success hinges on understanding the nuances of the market and partnering with a trusted advisor to navigate your journey from acquisition to exit. This is the essence of smart investing in whisky barrels-a deliberate strategy for long-term growth.

At the Whisky Cask Club, we demystify this process, providing our members with exclusive access to premium Scotch casks and the assurance of secure storage in accredited bonded warehouses. Our expert portfolio management and exit strategy advisory ensure your asset is managed with the same care and foresight with which it was created. We are here to transform your ambition into a tangible legacy.

Begin your journey and build your legacy with a whisky cask.

The most rewarding journeys begin with a single, deliberate step. Your cask is waiting.

Frequently Asked Questions About Investing in Whisky Barrels

How much does it cost to start investing in whisky barrels?

The entry point for investing in whisky barrels is more accessible than many presume. A new-fill cask from a reputable distillery can begin in the range of £2,000 to £5,000. For casks with greater age or from a highly sought-after, premium distillery, the initial investment will be higher. Our experts curate options to align with your specific portfolio goals, ensuring the provenance and potential of every tangible asset we source for our members.

Is investing in whisky casks a profitable venture?

Historically, whisky cask investment has demonstrated impressive returns, often outperforming traditional assets. Profitability is driven by the maturation process; as the whisky ages, its quality, complexity, and rarity increase, enhancing its value. While past performance is not a guarantee of future results, the consistent global demand for premium aged Scotch provides a strong foundation for this tangible asset class. It is a considered strategy for building a lasting financial legacy.

What is the typical holding period for a whisky cask investment?

We advise a medium to long-term approach to realise the full potential of your investment. A typical holding period ranges from 5 to 10 years, though many investors hold for longer to achieve significant age statements. This allows the spirit sufficient time to mature and develop the complex character that commands premium prices on the market. Our team provides guidance on the optimal maturation timeline for your specific cask to maximise its value.

Do I have to pay taxes on my whisky cask investment?

In the UK, a whisky cask is typically considered a ‘wasting asset’ by HMRC as it has a predictable life of less than 50 years. This means that profits from the sale of your cask are generally exempt from Capital Gains Tax (CGT). This tax efficiency is a significant advantage of cask ownership. However, we always recommend that our clients seek independent financial advice to understand the specific tax implications relevant to their personal circumstances.

Can anyone invest in whisky barrels, or is it only for experts?

While a passion for whisky is a rewarding starting point, deep expertise is not a prerequisite for our clients. Our purpose is to provide exclusive access and expert guidance, demystifying the process for discerning individuals. We manage every detail, from sourcing casks with exceptional provenance to overseeing their maturation and eventual exit. Our service is designed for those who wish to build a premium asset portfolio, guided by trusted, knowledgeable advisors at every step.

What is the ‘Angel’s Share’ and how does it impact my investment?

The ‘Angel’s Share’ is a poetic term for the small amount of whisky-typically around 2% per year-that evaporates from the cask during maturation. This is a natural and essential part of the aging process, allowing the spirit to breathe and interact with the wood. While it results in a slight reduction in volume, this concentration is precisely what develops the whisky’s rich character and deepens its complexity, ultimately contributing to the cask’s final value.

How do I physically see or sample my whisky cask?

Owning a cask is a tangible experience. We can arrange for you to visit the bonded warehouse where your asset is securely stored, allowing you to see your investment firsthand. Furthermore, we can facilitate the drawing of samples from your cask upon request. This allows you to follow the spirit’s journey, tasting its development as it matures over the years-a truly exclusive privilege of cask ownership and a core part of building your legacy.