The world of whisky cask investment can seem as complex and closely guarded as the distilleries themselves, a landscape often perceived as impenetrable for those just starting out. Yet, beneath the layers of heritage and jargon lies a tangible, rewarding asset class. This guide is designed to demystify the process, providing a clear and authoritative introduction to whisky investment for beginners. We understand the concerns-from the fear of disreputable brokers to the uncertainty surrounding valuation and long-term commitment.

Consider this your definitive starting point. Here, you will discover the essential first steps to building a personal cask portfolio with confidence. We will equip you with the knowledge to understand the market, identify a truly premium opportunity, and partner with a trusted advisor for your journey. It is time to move beyond apprehension and begin curating a tangible legacy, one cask at a time.

Key Takeaways

- Understand how whisky casks function as a premier tangible asset, offering a compelling way to diversify your portfolio away from traditional markets.

- Follow a clear roadmap for whisky investment for beginners, outlining the crucial steps for performing due diligence and making your first acquisition with confidence.

- Learn to identify the key factors that determine a cask’s value, from distillery provenance and age to the type of wood used for maturation.

- Develop a strategic approach to managing investment risks and planning your exit strategy to help secure the returns you envision for your portfolio.

Why Invest in Whisky Casks? The Marriage of Passion and Profit

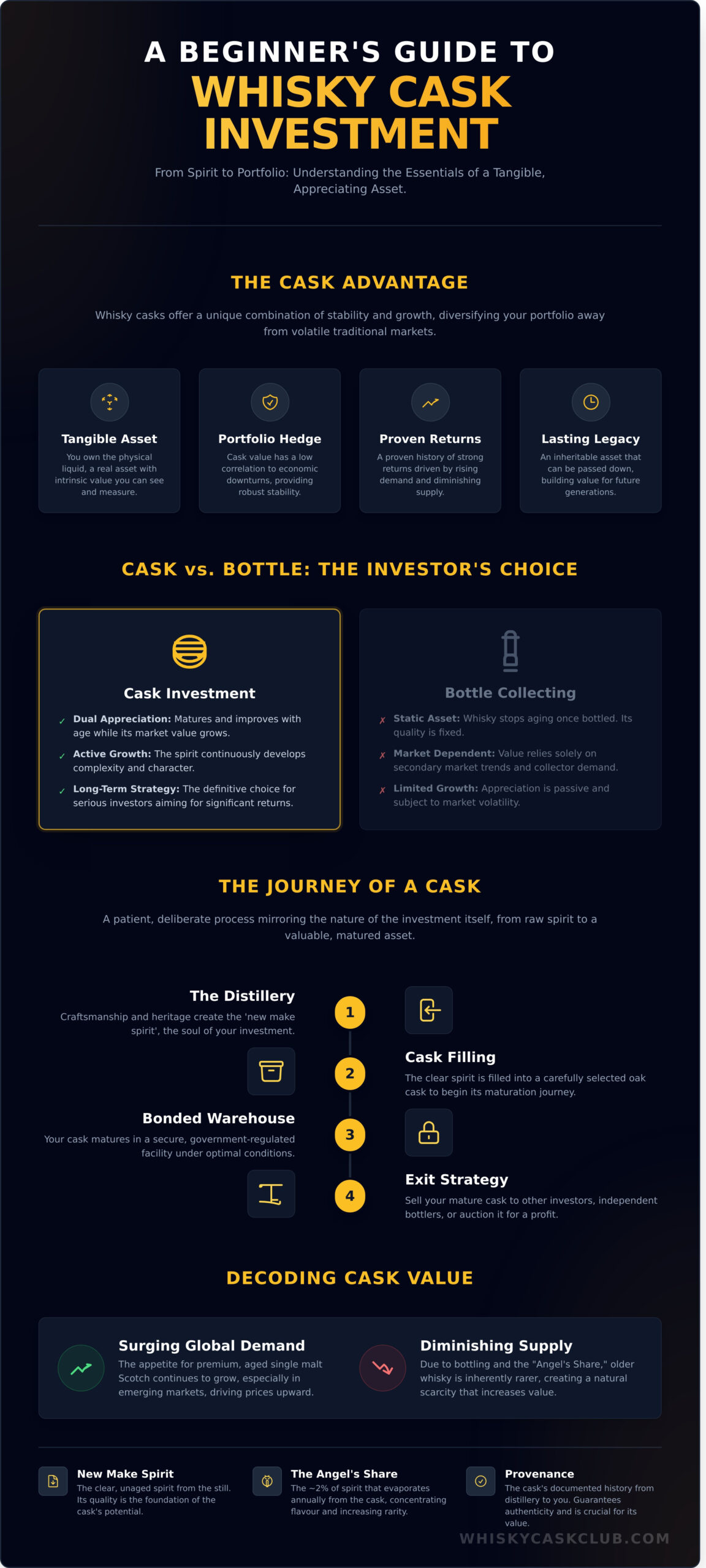

In the world of finance, discerning investors increasingly look beyond traditional stocks and bonds for assets that offer both stability and significant growth potential. Whisky cask ownership has emerged as a premier alternative asset class, offering a unique blend of tangible value and profound heritage. For those exploring whisky investment for beginners, understanding the unique advantages of cask ownership is the foundational first step. Unlike volatile public markets, the value of a whisky cask has a low correlation to economic downturns, providing a robust hedge for a modern portfolio.

Owning a cask is an investment in a tangible, appreciating asset with a proven history of strong returns. It is a direct stake in centuries of craftsmanship and tradition. This connection to a storied past is a significant part of the allure, as the rich history of whisky is intertwined with the value of each cask. More than a simple commodity, a cask of maturing Scotch is a physical, inheritable asset-a rare opportunity to build a lasting legacy for future generations, one that can be both sipped and sold.

Casks vs. Bottles: The Investor’s Choice

While collecting rare bottles has its appeal, serious investors focus on the source. Whisky only ages, matures, and develops its complex character while inside an oak cask. Once bottled, it is a static product whose value relies solely on market demand and secondary market trends. Cask ownership, however, offers dual avenues for appreciation: the spirit improves with age, and its market value grows simultaneously. This makes it the definitive choice for a long-term whisky investment for beginners and seasoned collectors alike.

Understanding the Market Drivers

The value of cask whisky is underpinned by clear and powerful economic principles. The global demand for premium, aged single malt Scotch continues to surge, particularly in emerging markets. This rising demand meets a naturally diminishing supply; every year, the amount of 20-year-old whisky becomes less than the amount of 19-year-old whisky. This principle of scarcity, combined with the provenance and reputation of celebrated distilleries, creates a compelling environment for asset appreciation.

The Foundations: How Cask Investment Actually Works

At its heart, whisky cask investment is the art of acquiring a tangible asset-the spirit itself-and nurturing it through the maturation process. Unlike stocks or bonds, you own the physical liquid as it transforms from a fiery, clear spirit into a complex, amber-hued whisky of significant value. Understanding this lifecycle is the first crucial step in whisky investment for beginners, turning a passion into a pragmatic strategy for building a legacy.

The journey of a cask is a patient, deliberate process, mirroring the nature of the investment itself. It can be visualised in four key stages:

Distillery → Cask Filling → Bonded Warehouse → Exit Strategy

The Key Players in Your Journey

Your investment is supported by a network of specialists, each playing a vital role. The Distillery is the source, the very soul of your investment, where craftsmanship and heritage create the ‘new make spirit’. The Bonded Warehouse is the secure, government-regulated vault where your cask will mature under optimal conditions, protected and insured. Finally, your Broker or Investment Club acts as your trusted advisor and guide. A reputable partner is paramount for sourcing rare casks, managing your portfolio, and navigating the market to avoid the potential risks of whisky investment that can arise from dealing with less scrupulous operators.

Decoding the Language of Whisky Casks

To invest with confidence, you must speak the language. This lexicon is steeped in tradition but is straightforward once understood. Here are the core terms every aspiring cask owner should know:

- New Make Spirit: This is the clear, unaged alcoholic liquid that flows directly from the distillery’s stills. It is the foundational element, full of potential, which will draw all its colour and much of its complex flavour from the cask it is filled into.

- Maturation & The Angel’s Share: Maturation is the magical transformation that occurs as the spirit ages in the oak cask. During this time, a small amount of spirit (around 2% per year) evaporates through the porous wood. This natural loss is poetically known as the “Angel’s Share.”

- Provenance: This is the cask’s unimpeachable history-a clear, documented line of ownership from the distillery to you. Strong provenance is non-negotiable; it guarantees authenticity and underpins the cask’s future value.

- Regauging: A periodic health check for your cask. This process measures the exact volume of liquid remaining (in litres) and its alcoholic strength (ABV). Regauging provides a precise snapshot of your asset’s status as it matures.

Your First Steps: A Beginner’s Roadmap to Cask Ownership

Embarking on the journey of cask ownership is a significant decision, one that blends passion with pragmatism. A structured approach transforms this aspirational goal into a tangible reality. This roadmap is designed to demystify the process, providing the foundational knowledge required for a successful whisky investment. With a clear strategy and a trusted advisor, you can navigate your first acquisition with confidence and precision.

Step 1: Define Your Investment Goals & Budget

Before exploring specific casks, it is essential to define your personal objectives. Consider your financial commitment, not just for the initial purchase but for all associated costs over the lifetime of the asset. Equally important is your time horizon; a cask intended for a 5-year maturation will have a different profile than one destined to become a rare 20-year-old single malt. Determine your primary goal: are you seeking pure capital appreciation, a unique diversification for your portfolio, or the creation of a personal legacy to be bottled and shared?

Step 2: Choosing a Reputable Partner

The single most important decision you will make is selecting your partner. A distinguished broker or members’ club provides more than just access; they offer expertise, security, and peace of mind. When vetting a potential partner, prioritise:

- Transparency: Clear information on all fees, processes, and the provenance of the cask.

- Expertise: A proven track record and deep knowledge of distilleries and market trends.

- Access: Direct relationships with a portfolio of premium and rare distilleries.

Be wary of high-pressure sales tactics or unrealistic promises of guaranteed returns. A true advisor encourages diligence and builds a relationship based on trust. This foundation is crucial for any successful whisky investment for beginners.

Step 3: Understanding the Costs of Ownership

A clear understanding of the financial structure is paramount. Your investment extends beyond the initial purchase price of the cask itself. You must account for ongoing annual costs, which typically include secure, bonded warehousing and comprehensive insurance. These fees protect your tangible asset as it matures. Further down the line, you may also encounter costs related to re-gauging, bottling, or exit fees upon sale. A reputable firm will provide a clear schedule of all potential costs from the outset. Request a consultation to understand our transparent ownership structure.

Key Factors That Determine a Cask’s Value

Not all casks are created equal. For those embarking on whisky investment for beginners, understanding the nuanced variables that define a cask’s potential is the first step towards building a valuable portfolio. These factors are the foundation of a cask’s story, its character, and ultimately, its future worth. Discerning between a good asset and a truly exceptional one requires a deep appreciation of these core principles.

The Distillery’s Pedigree and Provenance

The reputation of the distillery is paramount. A cask from an iconic, globally sought-after brand like Macallan or Dalmore carries an inherent premium from day one. The ultimate prize for investors, however, are casks from “silent” distilleries-those that have closed permanently, such as Port Ellen or Brora. With a finite and ever-dwindling supply, their rarity ensures exceptional long-term value appreciation.

The Cask Itself: Wood, Size, and History

The vessel that matures the spirit is just as important as the liquid itself. The cask imparts the majority of the whisky’s flavour and colour, directly influencing its desirability. Key considerations include:

- Wood Type: European oak, particularly ex-sherry casks, are highly prized for the rich, complex flavours they bestow and often command higher prices than their American ex-bourbon counterparts.

- Fill History: A “first-fill” cask, used for the first time to mature Scotch, will have the most profound impact on the spirit and is considered the most valuable.

- Size: Smaller casks like barrels offer a greater wood-to-spirit ratio, accelerating maturation, while larger butts are ideal for extended aging over decades.

Age and Rarity: The Simplest Value Multipliers

Time is the most reliable driver of a cask’s value. As the spirit matures, its flavour profile deepens and its value climbs. This is compounded by the “Angel’s Share”-the small amount of whisky that evaporates each year, making the remaining liquid rarer. Value often sees significant increases as a cask passes key age milestones, such as 10, 18, or 25 years, making it eligible for premium single malt bottlings.

Navigating these intricate factors is where expert guidance becomes critical. A trusted advisor can help you interpret this complex landscape, ensuring your investment is not just a purchase, but the beginning of a legacy. To learn how we curate our exclusive cask selections, explore the Whisky Cask Club portfolio.

Navigating the Risks and Planning Your Exit

A truly sophisticated investment is defined not only by its potential for growth but by a clear understanding of its risks and a well-defined plan for realising its value. Cask ownership is a strategic acquisition of a tangible asset, not a gamble. A crucial part of whisky investment for beginners is appreciating that with expert guidance, potential risks are both understood and meticulously managed from the outset.

Understanding and Mitigating Risks

Every investment carries a degree of risk, but in the world of premium whisky casks, these are mitigated through careful planning and protection.

- Market Fluctuations: While the value of whisky casks has shown strong historical performance, markets can fluctuate. However, as a long-term asset, your cask’s value is fundamentally driven by its age and rarity, providing a layer of insulation against short-term volatility.

- Physical Loss: A small amount of spirit naturally evaporates from the cask over time-a poetic process known as the “Angel’s Share.” To protect your asset from more significant events like leaks or damage, every cask we manage is fully insured, giving you complete peace of mind.

- Illiquidity: A cask of whisky is not traded as quickly as a stock. This illiquidity encourages the patient, long-term approach where the most significant value is created. It is an asset to be held and matured, not hastily traded.

Your Exit Strategy: Realising Your Investment

Your exit strategy is not an afterthought; it is an integral part of your investment plan from day one. When your cask has reached its optimal maturation and value, we leverage our extensive global network to facilitate a seamless exit. The most common pathways include:

- Selling the cask to another private investor or collector.

- Selling the cask back to the original distillery or to an independent bottler seeking rare, mature stock.

- Bottling the whisky for your own private collection or for specialist retail-the ultimate way to realise a personal legacy.

Navigating these channels requires expertise, which is a cornerstone of our service. We guide you through every step, ensuring the process is transparent and profitable. This dedicated support transforms the complexities of the market into a clear advantage for those embarking on their journey in whisky investment for beginners.

Begin your legacy. Explore cask ownership with the Whisky Cask Club.

Your Legacy Begins with a Single Cask

Embarking on the path of cask ownership is more than a financial decision; it is an investment in craftsmanship, heritage, and a tangible asset that matures in both character and value. As this guide has shown, understanding the fundamentals of distillery provenance and the nuances of maturation is the cornerstone of building a successful portfolio. This knowledge transforms the complex world of whisky investment for beginners into a clear and rewarding pursuit.

The most rewarding journeys, however, are rarely taken alone. At Whisky Cask Club, we provide our members with privileged access to exclusive casks from world-renowned distilleries, all managed and protected within secure, HMRC-accredited bonded warehouses. Our expert team offers dedicated portfolio management and clear exit strategy guidance, ensuring your investment is as secure as it is rewarding. The story of your future legacy is waiting to be written.

Start your whisky investment journey. Schedule a private consultation today.

Frequently Asked Questions About Whisky Cask Investment

How much money do I need to start investing in whisky casks?

The capital required depends on the cask’s age and provenance. While some assume it is out of reach, a curated portfolio for whisky investment for beginners can be established from a surprisingly accessible starting point, typically from £5,000. This provides access to premium new-make spirit from respected distilleries. Our expert advisors will guide you towards acquiring a tangible asset that aligns perfectly with your financial goals and helps you begin building your legacy in the world of fine spirits.

Is whisky cask investment tax-free in my country?

In certain jurisdictions, such as the United Kingdom, maturing whisky is often classified as a ‘wasting asset’ by HMRC. This means it may be exempt from Capital Gains Tax upon its sale. However, tax legislation is complex and varies significantly between countries and individual circumstances. We strongly advise that you seek independent, professional advice from a qualified tax consultant in your country of residence to understand your specific obligations and potential advantages before proceeding with any investment.

How long should I plan to hold a whisky cask before selling?

Whisky cask ownership is a medium to long-term investment strategy. We typically advise clients to plan for a holding period of 5 to 10 years, though longer holds can yield more significant returns. The liquid’s value appreciates substantially as it matures, especially as it crosses key age statements like 10, 12, or 18 years. Patience is paramount, as time is the essential element that enhances both the character of the spirit and its ultimate financial value.

How do I get proof that I actually own the cask?

Your ownership is absolute and unequivocally documented. Upon purchase, you will receive a Certificate of Ownership that details your cask’s unique identification number, the distillery of origin, and its fill date. Crucially, your cask is registered under your name at an independent, government-regulated bonded warehouse. This provides a clear and verifiable chain of title, ensuring your tangible asset is legally and physically yours. You own the cask, and you own the liquid within it.

What is the ‘Angel’s Share’ and how does it affect my investment?

The ‘Angel’s Share’ is the traditional, romantic term for the small amount of spirit that naturally evaporates through the porous oak cask during maturation. This process, typically around 2% per year initially, is essential for the whisky’s development. While the volume slightly decreases, this concentration of the spirit enhances its flavour complexity, character, and rarity. This natural loss is a globally accepted part of the aging process that ultimately contributes positively to your cask’s appreciating value.

Can I visit my cask in the warehouse?

Yes, as the legal owner of the cask, you are entitled to visit your asset. These are highly secure, government-bonded facilities, so all visits must be arranged in advance through our team to comply with warehouse regulations. We are delighted to facilitate this for our clients, as we believe viewing your maturing cask is a profound and rewarding part of the ownership journey-a chance to connect with the tangible legacy you are building.

What happens if the brokerage company I use goes out of business?

Your investment is fundamentally secure because you, not the brokerage, are the sole legal owner of the cask. Your ownership is recorded at the independent, HMRC-regulated bonded warehouse where the asset is stored. This legal title ensures that if a brokerage were to cease trading, your cask remains your property, completely insulated from their business operations. This is a critical point of security for anyone considering whisky investment for beginners, guaranteeing your tangible asset is always protected.